PMC/PubMed Indexed Articles

Indexed In

- Open J Gate

- Genamics JournalSeek

- JournalTOCs

- China National Knowledge Infrastructure (CNKI)

- Electronic Journals Library

- RefSeek

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

- SWB online catalog

- Virtual Library of Biology (vifabio)

- Publons

- MIAR

- Euro Pub

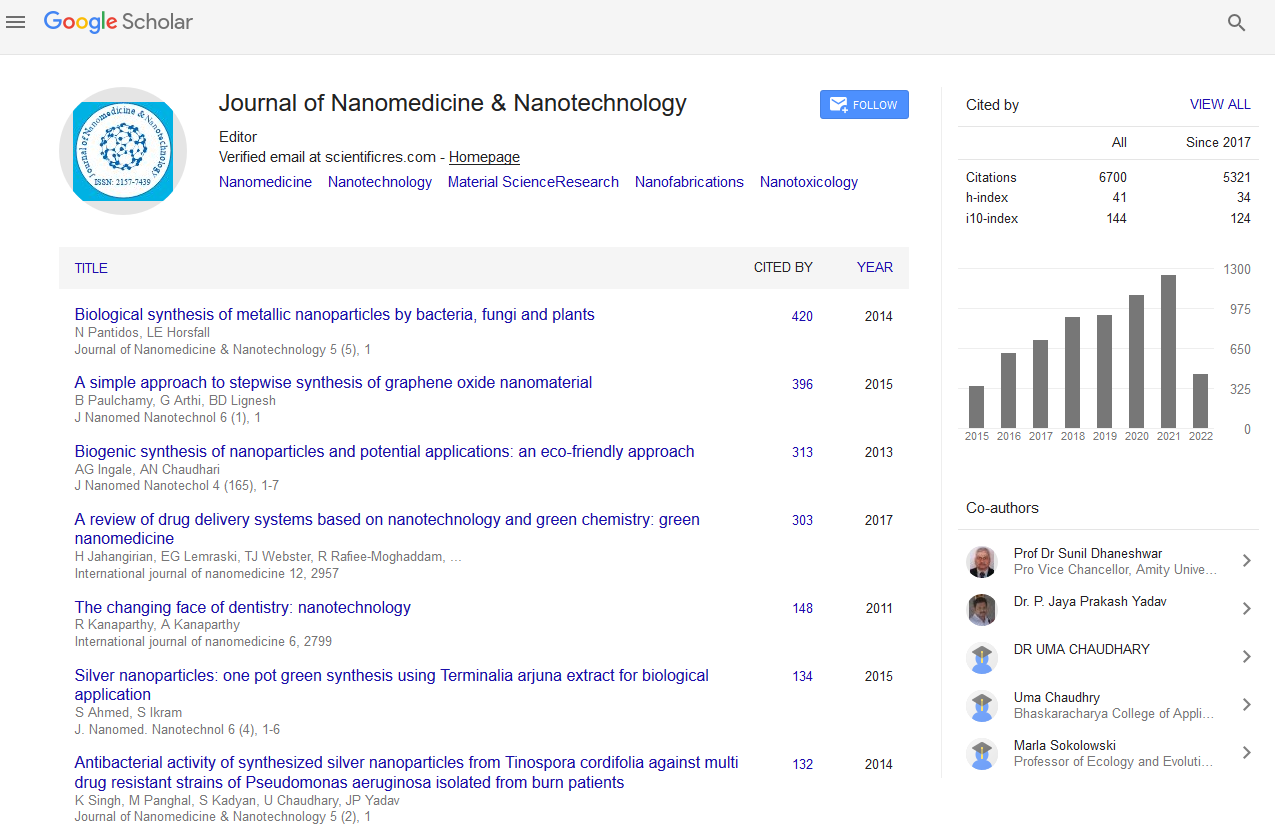

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Ethanol vs. Gasoline in Brazil: What to expect when sustainability is incorporated

World Congress on Petrochemistry and Chemical Engineering

November 18-20, 2013 Hilton San Antonio Airport, TX, USA

Henrique Pacini

Accepted Abstracts: J Pet Environ Biotechnol

Abstract:

Building upon previous studies on consumer choice of ethanol, and taking into consideration recent data on fuel consumption, prices and fleet characteristics in Brazil, this article develops an analysis of official price and consumption data, which has not shown a clear relationship between price-elasticities of demand for ethanol and growth of the flex-fuel fleet in the country. However, dispersion modeling of fuel choices has shown that as ethanol markets incorporate sustainability premiums, the resulting higher prices for certified E100 could shift a significant part of ethanol demand towards gasoline. In order to support national policymaking in making ethanol economically attractive, this article engaged in three quantitative exercises. The first is a measurement of price elasticities of demand for ethanol and gasoline in Brazil. The second contribution takes form of a statistical model describing how consumers have changed fuel preferences depending on relative prices between ethanol and gasoline. This model then serves as a basis for a simulation which seeks to forecast how ethanol consumption would behave in a scenario where sustainability certification costs are incorporated and transmitted to ethanol prices at the pump. The analysis indicated the fragile price-dynamics of ethanol in Brazil. The biofuel is continuously promoted to play a role in decarbonizing transport in Brazil and other countries pursuing ethanol as an alternative fuel. However, focusing only on ethanol is a difficult, myopic approach. As the bioethanol industry takes steps towards sustainability, fair consumer choice can only take place if sustainability criteria is also considered on gasoline prices. Given the limitation of policy tools to keep ethanol as a price-attractive fuel option, it is past the time to consider correctly pricing of gasoline, echoing the recent regulatory push for sustainability in biofuel markets. Only then externalities incorporated ? level playing fields conducive of renewables can be achieved

Biography :

Henrique Pacini works at the United Nations (UNCTAD) with issues concerning international trade, environment and development. His focus has been on biofuels trade, area on which he is currently finishing a Ph.D. examining the impacts of sustainability policies on the formation of global biofuel markets. Henrique holds a degree in Economics from the University of Sao Paulo (USP), including exchange studies at Eberhard Karls Tuebingen Universit?t, Germany. He also holds a master's degree in European Studies from Hochschule Bremen, Germany. He is currently concluding his Ph.D. at KTH in Sweden. Having broad experience in international institutions, Henrique has worked on research initiatives for biofuels and sustainable development at the European Commission (DG ENERGY), at the Ministry of Finance of Brazil (SEAE) and for the United Nations.