Indexed In

- Open J Gate

- JournalTOCs

- The Global Impact Factor (GIF)

- RefSeek

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

- Publons

- Euro Pub

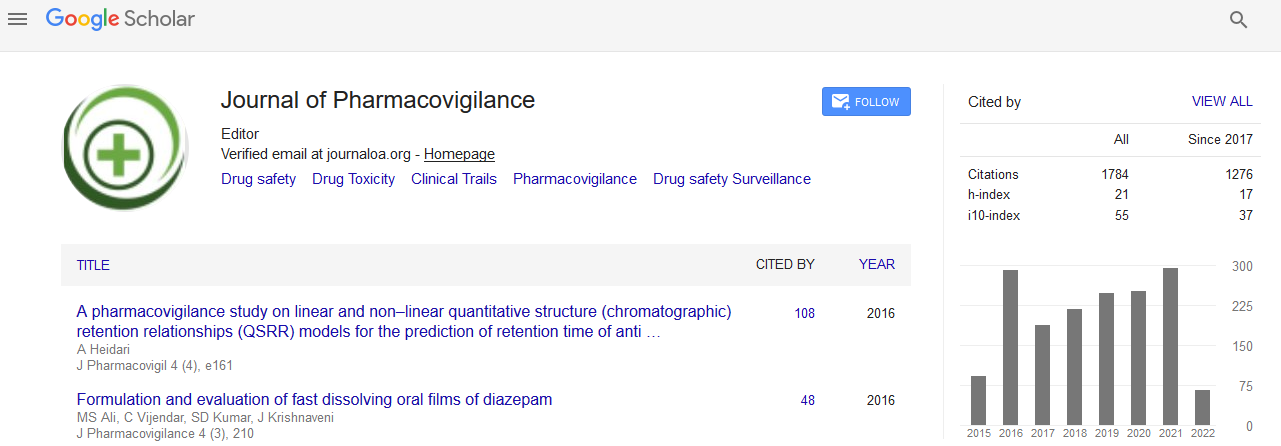

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Heterogeneity in the relationship between competition and innovation: A quantile approach

Conference Series LLC Joint International Event on 7th Pharmacovigilance & Pharmaceutical Industry

August 22-24, 2016 Vienna, Austria

Giovanni Alberto Tabacco

Swansea University, UK

Posters & Accepted Abstracts: J Pharmacovigil

Abstract:

Competition (measured by inverse of mark-ups) has been shown in the recent empirical literature to exert variable effects (positive/ negative, and inverted-U) on firm-level innovation which is measured by citation-weighted patents. Extant research estimate the average relationship between competition and innovation based on the conditional mean function of innovation. We argue in this paper that this provides only a partial view of the relationship, as we are yet to understand what might be happening at different points in the conditional distribution of innovation. Moreover, existence of structural break can also alter the sign of the relationship. To deal with these issues, we employ panel quantile regression approach to the publicly traded manufacturing firm�??s data in the United States obtained over a period of 25 years. While we find that the negative relationship between competition and innovation may exist, such a finding is not uniform across the entire distribution of innovation. There is a significant evidence of over-estimation of the negative effect from the median quantile. Moreover, after accounting for the well-known structural break (i.e., the establishment of United States Court of Appeals for the Federal Circuit in 1982) and possible endogeneity bias, the sub-sample estimation of quantile regression evince contrasting conclusions: Inverted-U shaped before the break point and U-shape relationship after the structural break.

Biography :

Email: G.A.Tabacco@swansea.ac.uk