Page 103

conferenceseries

.com

Volume 6, Issue 4 (Suppl)

Agrotechnology, an open access journal

ISSN: 2168-9881

Agri 2017

October 02-04, 2017

allied

academies

10

th

International Conference on

AGRICULTURE & HORTICULTURE

October 02-04, 2017 London, UK

Evolution of the tomato market in Argentina (

Ex aecquo

)

Ana María Castagnino

1

, Karina E Diaz

1

, Sabrina Mondini

1

, W John Rogers

1

, Andrea Guisolis

1

, Oscar Liverotti

2

, José Fernandez Lozano

3

and

Mario E

Peralta

4

1

UNCPBA, Argentina

2

Pontifical Catholic University of Argentina, Argentina

3

University of Buenos Aires, Argentina

4

University of Belgrano, Argentina

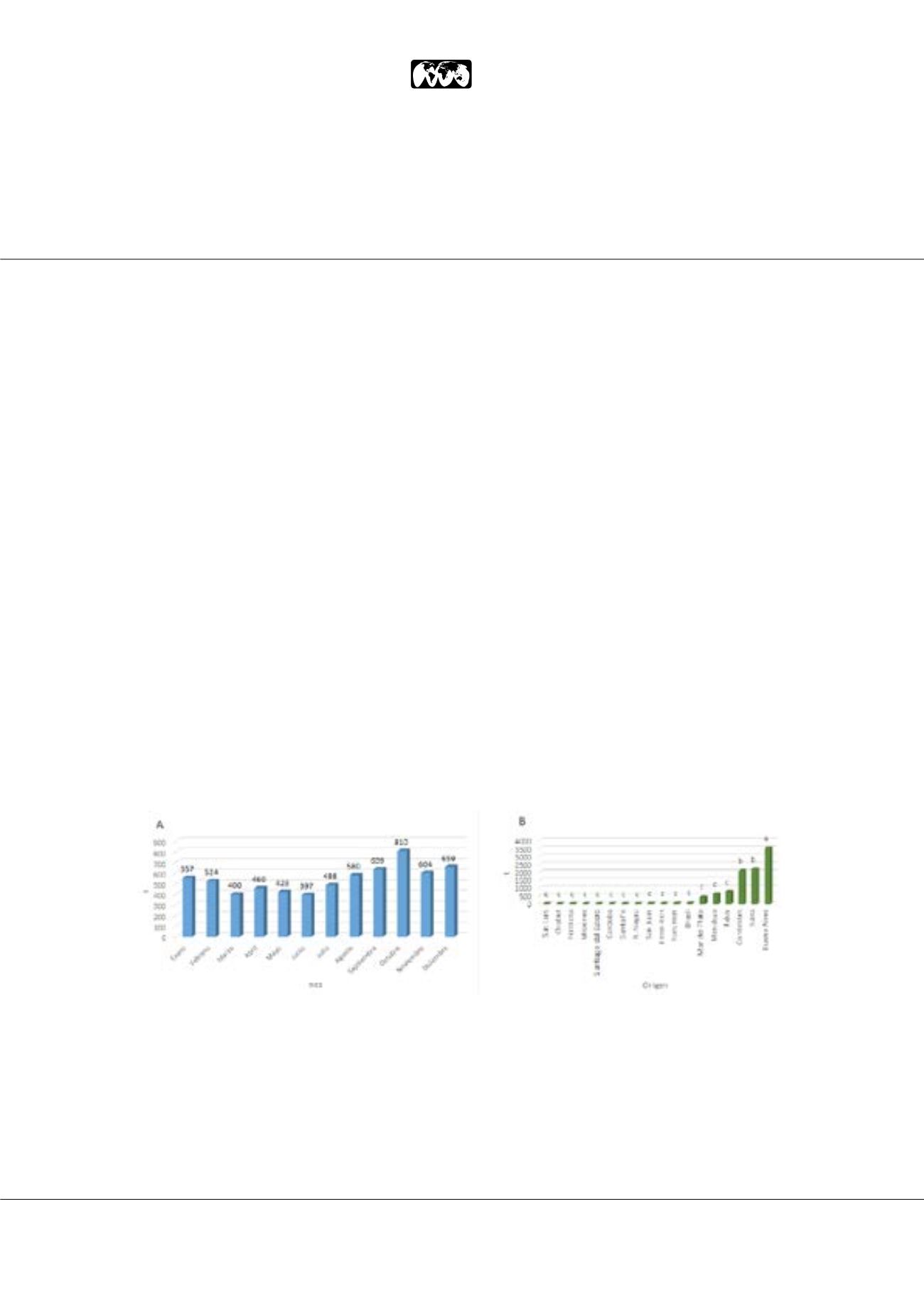

T

omato is the principal greenhouse vegetable grown in Argentina. The aim of the current work is to analyse tomato market

evolution in this country, based upon volumes received by the Buenos Aires Central Market, the main national point of

reference. The following aspects were evaluated: total commercial volumes (CV) 1999-2016, evolution (E) and mean prices

(MP), principal varieties (V) commercialized in 2016, origin (O), distribution by province of origin (DP) and the proportion

that tomato comprises of the total volume (TV) of the horticultural produce commercialized in the reference period. For the

factors evaluated, one-way analysis of variance was carried out on the tonnage values. The VC was 119,600, with a decrease

over the period of 18% compared to the first year (1999: 142,968t and 2016: 117,744 t/year). In 2016, the mean monthly E

was 9812t, where the following months exceeded this value, without significant differences between them: October-14586,

December-11870, September-11494, November-10865, August-10446 and January-10027 t. The annual MP was 0.62 US$kg

-1

,

which was exceeded in September (1.03), May (0.82), October (0.80) and November (0.63). For DP, the highest volumes were

observed for Buenos Aires: 3936t

a

, Salta: 2187t and Corrientes: 2081t

b

, with the remaining origins in the following order of

importance, without significant differences between them: Jujuy-774, Mendoza-625, Brasil-72; Tucumán-48; Entre Ríos-29;

San Juan-28; Rio Negro-9.82, Santa Fé-8; Córdoba-5.15; Santiago del Estero-2.82; Misiones-2; Formosa-1.4; Chubut-0.75 and

San Luis-0.2 t

c

. Overall, tomato represented 14% of the TV (850240t) commercialized (16.7% in 1999 and 13.8% in 2016).

For V, the monthly volumes gave differences for Larga Vida (October

a

, November, July, February, September, August and

June

ab

); for Platense (January and December

a

, April and February

ab

) and the rest

b

. For origin, differences were found for all

varieties: Larga Vida: Corrientes

a

and the rest

b

, Perita: Salta

a

, Jujuy, Buenos Aires

b

and Mendoza

bc

, Cherry: Buenos Aires

a

, Salta,

Corrientes

b

and Jujuy

bc

, Redondo: Buenos Aires

a

, Corrientes

b

and Salta

ab

. These results provide evidence of the positioning of

tomato throughout the year in the Argentinean market.

Biography

Ana María Castagnino is a Horticulture Specialist (UNIPI, Italy) with a Master's Degree in Business Management (UNCPBA, Argentina), and is Professor of

Horticulture at UCA, Buenos Aires and Associate Professor at UNCPBA. She is a member of CRESCA (Regional Centre for the Systemic Study of Agro-Food

Chains) and directs the programme "Promotion of the production and consumption of asparagus and other non-traditional vegetables".

amc@hotmail.comAna María Castagnino et al., Agrotechnology 2017, 6:4(Suppl)

DOI: 10.4172/2168-9881-C1-028