A Novel Research Approach for Whole-Life-Cycle Electrical Power Systems Asset Management Using Retroductive Case Study Method

Received: 10-May-2020 / Accepted Date: 05-Jun-2020 / Published Date: 10-Jun-2020 DOI: 10.4172/2576-1463.1000234

Abstract

There are a vast number of complex influences on power systems assets both individually and as a collection of systems of assets. The complexities when governing what and when to intervene with these assets is played out over varying time frames and represents a mixture of engineering, processes, technology, people and economic contributions. The importance of governing power systems holistically has been shown across decades with outages, safety issues, investment needs etc. As of today, research is yet to provide the effective governance framework to manage power systems assets holistically as-a-system; whilst aggregating decisions made at single asset level to generate consistently better outcomes. This paper sets out an approach to researching the phenomenon of asset management applied to power systems by utilising advancements in engineering asset management research and complex adaptive systems; whilst combining industry contributions and technical practices to ensure the suitability of future work. Ultimately the aim of this paper is to provide guidance and method to holistic decision making for power system companies and the management of power systems assets across the whole life.

Keywords: Electrical power; Production technology; Power industry; Mining industry; Rail industry

Introduction and State of the Art

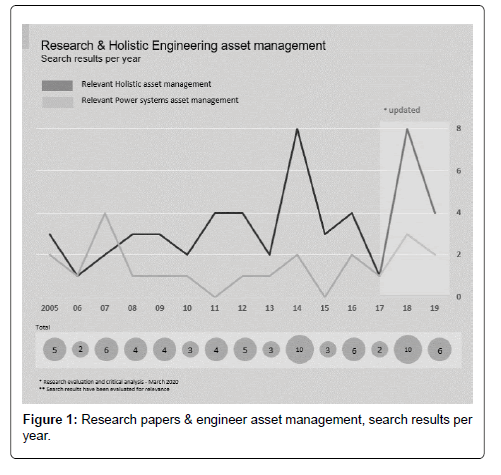

Research and historic approaches to managing electrical power systems have resulted in ‘silo’ like contributions [1-3] whilst lacking in overall system wide governance. In the past Asset Management in an engineering context has largely been limited to ‘maintenance’ related activities and resulted in singular vein asset management system enhancements. A review of scholarly work was conducted and whilst more recent research examples including [4-6] will help in changes to economic governance and decision making for expanding micro grids, these ‘agents’ need governance inside the system of outcomes that the power company needs to achieve in the full context of electrical power provision (Generation, Transmission, Distribution, Metering etc.). Noting that the above power systems are complex, managing such associated assets consistently represents a mixture of processes, technology, people, locations, trends and economic contributions. All of which demonstrate characteristics of complex adaptive systems as characterised by the works [7]. In addition, the diversity in such systems as shown in the works [8] and time dependant decision interactions make the system adaptive and complex. The complexity, a point notably extended in works [9] stating that “The synthesis and design of processing networks is a complex and multidisciplinary problem, which involves many strategic and tactical decisions at business (considering financial criteria, market competition, supply chain network, etc.) and engineering levels (considering synthesis, design and optimization of production technology and R&D)”. This paper sets out an approach guided in principle by the works [10] and supplemented by complex adaptive systems whilst considering new advancements in expert systems (Figure 1).

In summary the purpose of the paper is to provide contribution in the following three areas:

1. Provide a method by which the phenomena of asset decision making can be established in the context of a power systems company. Resulting in organising governance models that can measure the effectiveness of a maturing asset management decision framework and the improvements across expenditure, risk and performance.

2. Provide a method by which a hypothesised model can be applied to a power system company; whilst observing measurable outcomes associated with it.

3. Adding to the body of knowledge in asset management by identifying the role of complex adaptive systems that ought to be considered when developing system frameworks for power companies.

Retroductive Case Study Methodology-identifing and Constructing Asset Management Governance Models

Recognising and the challenges associated with a company managing power systems assets highlights some of the broad timedependant complexities; For example, the components that underpin business, asset integrity, economic and social related decisions. This complexity is furthermore characterised as complex adaptive exhibiting different results over varying time frames. In understanding this further one must consider a method by which it is possible to observe phenomena in this context. Using works from it is possible to establish a general method in synthesising models and observing characteristics of interpolated system/framework design within an Asset Management context. This in the contextual guidelines offered in could offer a complex system approach to asset management. However, enhancements would be needed to the retroductive case study method. The proposal of this paper is toapply these works to electrical power systems, enhanced with characteristics of complex adaptive systems [11] and congicent of socio-technical contributors or actors such as business, customer, technological or otherwise [12]. By understanding the phenomenon in the asset management system whilst designing a framework with complex systems characteristics will therefore yield the greatest result. Notwithstanding the guiding principles outlined in it is possible to conclude that this approach is valid. Specifically, when considering the use of retroductive case study, “Relatedly [case research] fundamental concern with explaining why things occur, and with analysis through a process of retroductive inference, can challenge researches to move beyond the description of social situations to a more critical assessment of the relationship between structural factors and human agency.” In this manner it is important that this case study research with retroduction is capable of creating the correct conditions to best observe the complex phenomenon in a more detailed technological, business and real world situation [13], “The principle advantage of [case research] retroductive methodology, from the perspective of the policy-maker or practitioner, is that its purpose is to develop a theoretical understanding of real mechanisms...”, The importance of developing a new synthesis framework would enable the overlay of the model in relation to the power company functionally and therefore ensure interfacing/interactions with the organisational system. In conclusion retroduction will functionally enable subsequent reviews based on a proposed synthesised model in the real-world context by using case study research.

Case Study Design and this Method

The framework synthesis method for asset management systems has already been established. Albeit in relation to capital programmes and whilst not previously applied to the specific gap in power systems asset management across the whole-life-cycle. As stated, retroduction with case study method enables a good way to evaluate the capability of Asset Management Systems in a real-world context. Furthermore, this can be seen with the likes of when stating that “Retroduction from Events to Mechanism: A creative process which posits the existence of causal mechanisms that must exist within a social structure to produce the phenomenon of interest” meaning that a hypothesised framework together with retroductive case study would establish a means of measure from event to mechanism when observing and evaluating the phenomenon. This research method provides a systematic view by adopting principles from socio-economic and engineering methods to extend our knowledge and understanding of the Power Company and the decisions made to govern assets; When considering that research is validated by the ability to demonstrate knowledge [14,15]. Combining with works from who claims the approach is a dualism of validity, that is a) internal validity attached to validating case study design and b) the capability to conclusively correlate paths too cause-effect relationships. This method using both to understand if the framework has been implemented and the outcomes associated with it through synthesised governance framework and case study methods.

Research Method Overview

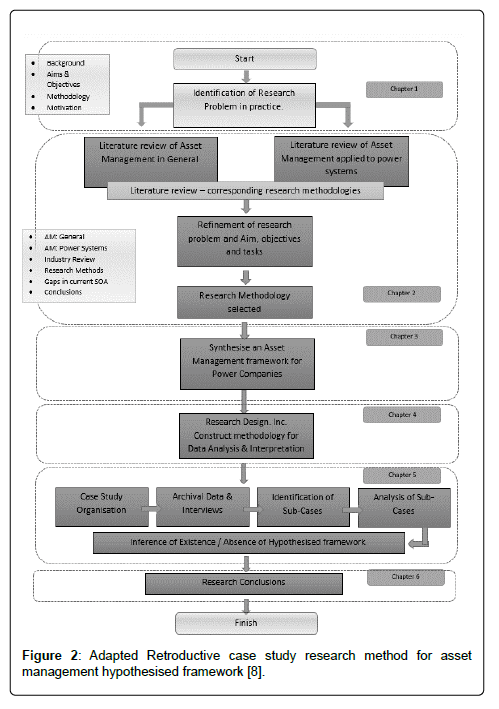

The research method is derived from a blended approach to retroductive case study and embedded cases as highlighted by published works on case study research. It is anticipated that several public sources of information could be consolidated to build the case study material. This is as a result of given that case studies are not usually made explicit. Through his works as stated in [16] that “The analysis of case study evidence is one of the least developed…” and goes even further to outline that the weight of validity rests on the competence of the investigator. Therefore, it is important that both the case reference and researcher are knowledgeable in the field of power systems and the researcher especially be competent with key concepts and applications of holistic and whole-life-cycle asset management (Figure 2).

Figure 2: Adapted Retroductive case study research method for asset management hypothesised framework [8].

Applied and Tailored Retroductive Case Study Design

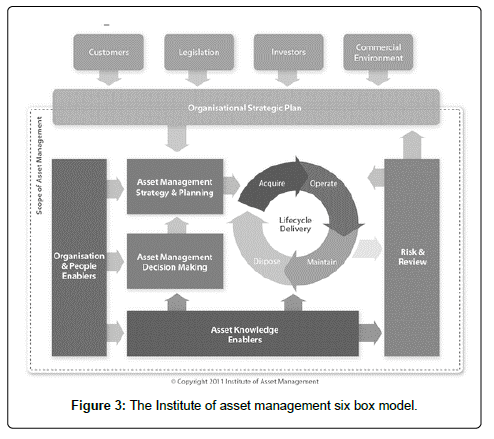

Whilst research in capital programmes is established it is important to recognise the need for industries to align capability across the application of asset management systems as applied to the ISO 55001standard. Given that the capability of any asset management system for Power companies must also be aware of industry requirements. International standards are often the backbone of such requirements. Adding to the implementation of the frame work’s suitability in a real world context ensures the retroductive case study requirements are upheld in this research method context. Substituting the bespoke functional reference model as detailed in the literature means that a future governance model would be free to make use of both academic and industrial methods such as from the Institute of Asset Management six box model as shown in Figure 3.

To create a robust capability in adjoining ISO 55000:2014 and a functional model, the framework must be built considering ISO 55000:2014 requirements. This importance can be further seen by the likes [17] by creating the conditions for a synthesised compliant ISO 55001 framework, that will help in correctly positioning the asset management research through acceptance and industry requirement, in the later report it is noted that “Asset management optimization is critical to business performance and profitability, especially for electric power industry in recent years,” furthermore stating that “… ISO 55000 is the first international asset management standard which provides terminology, requirement and guidance for implementing, maintaining and improving an effective asset management system.” Therefore, the synthesised framework and applied functional model must ensure its robustness through its compliance to align ISO 55001.

Structuring the Procedure

As future research in this field would centre on the successful analysis of the synthesised asset management framework, the process of data collection, extrapolation, analysis and understanding must be structured in such to verify the model hypothesised. As outlined in it is proposed to establish a pattern of recognising the phenomenon, through:

Data collection and sorting

Involves the identification of system event-including definition of the asset solution, provision of asset solution and establishing the outcomes.

Analysis and interpretation

Involves establishing the interpreting the Asset Management control action.

Stage 1: Establishing the phenomenon

Table 1 below, ‘Appropriate methods’, derived from stage one process in shows the steps used in this research.

| Step # | Steps description | Proposed in this research |

|---|---|---|

| 1 | Identification of a Strategy Event or Change: This involves identifying a strategy event/change that took place as a consequence of some external or internal triggers. | ✓ |

| 2 | Definition of the Asset Solution: This involves identifying the particular asset solution(s) adopted in response to the change in strategy. Definition involves determining if the response was an asset solution and what resulted from that response. This occurrence of an asset solution in response to change in strategy defines the sub-case to study as proposed by the model. | ✓ |

| 3 | Provision of the Asset Solution: This requires the recording of how the asset solution was provided. This includes detailed of designs, plans, testing, resources used, budgets and procedures of implement the solution for example. | ✓ |

| 3.1 | Establishing the resulting asset performance associated with the selected asset solution. This involves defining whether these resulted asset performance indicators are in compliance with the designed or targeted performance. | ✓ |

| 3.2 | Establishing how the resulting asset performance is translated in business outcomes. The resulting business outcome is an indication of the outcome of the Asset Management system. | |

| 3.3 | Establishing whether the resulting asset performance has resulted in positive or negative value contribution. This involves/indicators of the value contribution or distribution as delivered by the asset management system. Positive contributions is an indication of the existence of adequacy or inadequacy of the asset management system. | ✓ |

Table 1: Appropriate Methods, derived from stage one process [8] shows the steps used in this research.

Stage 2: Drawing implications from the phenomena

To interpret how the synthesised framework and proposed model provides the holistic power asset management system capability we will compare and contrast the control actions as explained above from the data collected and as states, ‘Establishing and interpreting the Asset Management system in place involves verifying the existence or absence of the activities, relationship and mechanisms of Asset management system as postulated by the framework. Establishing the existence (adequacy) or absence (inadequacy) of these involves…’ when referring to his applied four principles method and also aligns with this research.

Table 2 ‘Drawing implications’ compares the proposed proposition with the requirements in light of power systems asset management.

Step # |

Step outlines | Adaptation for Power Systems Asset Management | Utilised as part of this research |

|---|---|---|---|

| 1 | Establishing how the organisation decided that a certain strategy event or change required an asset solution. This will provide some indication as to the existence or absence of the relationship between Asset Management and the organisational strategic development process. This will indicate how the Asset Management strategic planning and control activities handle the relationship with the strategic management system and the interface-relationships with external environment such as supplier, contractors, outsources, manufacturers, regulators or environmentalists for example. | In principle the step is applicable, however the tailoring of this step will include the following: Ensure each of the Six functional applications found in the Institute of asset management model is used for holistic representation, this will also be contrasted throughout the hypothesised model and ISO 55000. | ✓ |

| 2 | Establishing how the Asset Management system established the possible solutions and how the particular adopted solution was selected over others as the most suitable to achieve the strategic objectives. This will provide an indication of the existence or absence of the Asset Management strategic planning and control activities their interrelationships and control cycle as proposed by the model’s control mechanism. These include analysis, evaluation of the gap in the resulting asset performance to achieve the business performance for the strategic objectives. They also include the decision activities based on the feedforward flow from the strategic business management and the feedback from the other two levels of activities in the models control and feedback cycle. | The adaptation of this point will again lean back to the underlining applicability for Power Systems and Power Companies - in real terms that is expanded across the holistic life cycle for the power systems assets, not just from strategic planning. | ✓ |

| 3 | Establishing how the Asset Management system dealt with the provision of the asset solution to achieve the resulting asset performance. This will indicate the existence or absence of the Asset Management strategic planning and control activities their interrelationships and control cycle as proposed by the model’s planning and control mechanism. This includes analysis, evaluation or requirements of the asset-related activities top cope with the resulting asset performance. It also includes the decision activities based on the feedback from the other two levels of activities, aggregate and operational. | No supplementary notes required. | ✓ |

| 4 | Establishing how the Asset Management dealt with implementation of the asset solutions. This will give an indication to the existence or absence of the Asset Management aggregate planning and control activities and the asset management operational task control activities’. It also provides an indication to the interrelationships existing between these two lower levels of Asset Management system activities with the asset management strategic planning and control activities. These interrelationships include on one hand, a feedforward flow in a top-down direction for the solution implementation in terms of strategies’, policies, plans and task control of the asset-related activities. On the other hand, they include a feedback in a bottom-up direction as basis for carrying analysis, evaluation and decision making support for selection and formulation of the asset solution for the strategy. | Principally applied in this research, with a notable extension of Asset Strategy definition and as applied across the whole life cycle of the asset management system contribution. For example by using Complex Adaptive System thinking this research will look at individual contributors towards successful or in complete strategy in testing asset management capability. |

✓ |

Table 2: ‘Drawing implications’ compares the proposed [8] proposition with the requirements in light of power systems asset management.

In the proposed method by the writer explains, “This resulting customer value provided by the asset management system can be translated into contribution to the achievement of the organisational strategy. Therefore, in sub-case, explanation of how the structure and mechanism of the asset management system plays a role in the organisational strategy can be established…”, again supporting retroductive methods, complex adaptive system observation and as has been identified previously as representing a good fit in engineering asset management. This form of investigation approach promotes the notion that observation of asset management systems are linked to both the performance of decision making as a process and the outcomes from sub cases, whilst capable of taking additional information on-board to help supplement the review of the asset management capability as a whole. Whilst highlights that interpretation of the asset management system will require a corresponding cause and resulting effect pattern others such as [18] highlight the need of ISO 55001 for power companies in ensuring fully functional asset management capability. Both of these approaches remain acceptable, yet neither applies totally in a holistic system framework to ensure optimised asset management across the entire life cycle of power systems assets. It is clear both approaches imply that performance or outcome analysis will hinge on the retroductive case study research. To this end, applying a wider range of analysis regarding asset management decisions, data, information and functionally applied institute of asset management six box model will ensure the interpretation of results are founded in the context of both the Asset Management cause and resulting effect pattern while acknowledging the implications of the ISO 55001 compliant capability or lack thereof.

Considering the Type of Organisation and Data Collection Required

It is essential that a Power Company is used as the case reference whereby the synthesised framework can be utilised and whereby the phenomenon can be observed in a real world context. A range of works help build up a relevant definitions, such as power generation and transmissions [19], intelligent and smart distributed power infrastructure and more generalist critical infrastructure identification work such as [20] thus the following definitions are proposed in the context of the current research works.

Power systems

A complex assemblage of equipment and circuits for generating, transmitting, transforming, and distributing electrical energy. This can include physical and logical elements such as Information technological systems.

Power assets

Any object that is concerned with performing tasks in Power System(s), that is any mechanical, electrical or device that operates in field of electrical, mechanical or process engineering. It can be that which enables power to be generated, to be stored, to be moved or to be consumed as part of a wider power system function. This can include logical systems that build up such capabilities for physical components to operate such as information technological components or systems.

Power companies

The term used to identify a company concerned providing or consuming power as part of its business function. That is potentially owning, operating or legally responsible for power systems assets.

In addition this can include a company that has strong underlining business requirements for electrical power, either concerned for example in its core purpose or as part of a larger requirement to operate its business needs (such as Rail, Mining and Oil and Gas related power systems).

For example, in heavy industry such as a mining company it is identified as appropriate when reviewing their power systems asset in fulfilling underlining business requirements, be it environmental considerations, generation of electricity or removal of waste. Even though a company’s main function might not be to provide end users with power does not exclude it from being fully committed to the holistic life cycle management presented by power systems.

In this example, the company may require significant power assets (Generators, Transformers, Cables…) to perform their business function or a legal regulatory demand. Another example might be a rail company, although its primary function is not to Generate, Transmit or distribute electricity it requires power assets to deliver its corporate objectives. Some of the industries identified throughout the as indicated by include:

» Government Infrastructure organisations and industries

» Oil and Gas Industry

» Power Industry

» Petrochemical Industry

» Mining Industry

» Rail Industry

By selecting a power company as outlined above, the research has the ability to effectively overlay and review the synthesised framework in light of industry specifics. That is the capability of detailing and investigating effectively the phenomena in the industries it is intended to be applied in. As alludes to that research findings may not be useful to theorists or practitioners if they do not describe the actual behaviour of the organisation. Therefore, the researcher must be familiar with the organisational context, general applied technology, financial and other company requirements. As explained previously the design flow utilises the case study with ‘embedded case studies’ to observe connectivity between the organisation and asset management decisions made, particularly when using a hypothesised framework. However, the organisation remains the focus of the main case study, just as procedures reported in the literature and the retroductive approach to asset management research. The sub cases will therefore act as a depth gauge in correlating sequences of events in a historical collection designed to establish the causal relationships between events. Therefore the result of framework interventions/decisions can be characterised and chartered in light of their impact both at strategic level and also in historic event correlation. In summary it is the sub cases that will help prove or disprove the credibility of the case at organisational level to ensure each unit of analysis or sub cases validity upholds the relevance to its change, effects or impacts on the organisations asset management capabilities.

Naturally the above deals with historic pathways to observing phenomenon, in the case of future capability or forecasting across the entire life cycle a long-term reflection and defined performance indicators are required to effectively predict outcomes.

Sources and Data Collection

Work such as [21] demonstrates that a collection of qualitative/ quantitative mixed methods to research socio-technical contributions yields good results.Further, confirmation is also found in the works [22] that argues that combining quantitative and qualitative approaches in research design and data collection should be considered whenever possible. Such mixed-methods research is more time consuming than a single method approach but improves the validity and reliability of the resulting data and strengthens causal inferences by providing the opportunity to observe data convergence or divergence in hypothesis testing.” This combined method offers freedom to capture all the necessary data required in the context of the case study organization, which needs to be recognized maybe different in each case. Such archival data as records, organisational charts, progress reports, financial records, maintenance schedules, meeting minutes, publications, strategies’, standards, regulatory reviews, public articles etc. For some guidance the following data is likely to be collected:

1. Organisational Strategic data such as understanding organisational design, roles, responsibilities and regulatory influence.

2. Asset management strategy and planning such as how decisions are planned and how applied these decisions are in light of strategic direction, is it clear and evident that link between planning and strategy exists.

3. Asset management decision making to evaluate the actual decision making effectiveness, how do these decisions either contribute or not to the planning, strategy and organisation.

4. Risk and Review to consider how risk (physical, sociological or financial) influences or not the asset management system.

5. Lifecycle delivery will help highlight how entire life of the assets is considered, from Conceptual design to disposal.

Help correlate the ability of the asset management system to perform holistically.

6. Asset knowledge such as explore data related to the information management and information system contributions on the asset management system.

7. Organisation and people data such as understand competence, recruitment and people contribution the asset management system; this could include the effects of the system on the capability and confidence of its workforce to enact the asset management system.

Although it is the thought that certain elements of this model will represent a combination of various data types, it will be considered flexible to collect data from various sources. This is also recognised by stating that, ‘The asset solution data can be collected from what has been done through the life cycle phases. The business performance data can be collected as organisational output indicators. The resulting asset performance data can be collected as indicators relative to asset ‘technical system’ performance or relative to the performance of any activity. These indicators may be associated with single assets or technical systems, or with output or outcomes pertaining to each separate organisational activity.

As changes to the power system are evolving so is the current state of the art. However, a lack of holistic governance for power systems companies is still apparent, especially considering the future changes faced by power companies (physical, operational, financial etc.). Previously it has been challenging to observe asset management phenomena, however recognising its complex adaptive nature (isolating the agents of change within a system) and by using a retroductive case study approach with a hypothesised framework (providing a measurable baseline within a real-world context) would provide the bridge between academic and industrial application/acceptance.

Therefore a blended research approach including elements of retroductive case study method and hypothesis governance models to approach the complexity of an asset management system, including a realist approach to understanding the myriad of joint socio-technical contributions throughout the Asset management system is the most valid; an approach also endorsed in the literature (Figure 4) [23].

Conclusions

This approach could provide future research in asset management more comprehensive method by which to observe the phenomena of asset management effectiveness and offer a starting definition for better identification of ‘agents or components” that make up the diverse decision pathways. Thus offering greater understanding of how to consider the cause-effect correlation between observation and outcomes in the complex context of an asset management organisations. It would also help in accelerating the application and acceptance of hypothesised frameworks that could create a myriad of advancements through better understanding in regards to the contributions that could have originally created the ‘silo’ like approaches as outlined by Abowitz.

Finally, this method would offer industry with increased ability to consider its own asset management systems (legacy or new) and benefit from academic and industry application so of good practice in asset management resulting in improved safety, reduced overall whole life cost and improved performance.

References

- Bruiners (2017) The need for a whole life framework in electrical power system asset management and the problems with individual silo like asset management system contributions.

- Campbell J (2011) Asset management excellence: optimizing equipment life-cycle decisions. CRC Pres

- McArthur (2007) Multi-agent systems for power engineering applications, Part II: technologies, standards, and tools for building multi-agent system. Power Systems, IEEE Transactions 22(4): 1753-1759.

- Moein C, Mohagheghi S (2016) A multi-objective optimization framework for energy and asset management in an industrial Microgrid. Journal of cleaner production 139: 1326-1338.

- Gui, Emi Minghui, Mark Diesendorf and Iain MacGill. "Distributed energy infrastructure paradigm: Community microgrids in a new institutional economics context." Renewable and Sustainable Energy Reviews 72: 1355-1365

- Danilo S (2019) Efficient Asset Management Practices for Power Systems Using Expert Systems. Application of Expert Systems-Theoretical and Practical Aspects. IntechOpen.

- Durucan (2006) Mining life cycle modelling: a cradle-to-gate approach to environmental management in the minerals industry. Journal of Cleaner Production, pp: 1057-1070

- Quaglia (2012). Integrated business and engineering framework for synthesis and design of enterprise-wide processing networks.. Computers & Chemical Engineering pp: 213-223.

- Neergaard (2007). Handbook of qualitative research methods in entrepreneurship. Edward Elgar Publishing.

- El-Akruti (2012) The Strategic role of engineering asset management in capital intensive organisations, University of Wollongong.

- Smith A, Stirling A (2008) Social-ecological resilience and socio-technical transitions: critical issues for sustainability governance.

- Amin (2005) Toward a smart grid: power delivery for the 21st century. Power and Energy Magazine3(5): 34-41

- Miörne J (2015) Leadership in Regional Innovation Systems. A case study of two policy networks in the region of Scania, Sweden

- El-Akruti KO, Dwight R (2010) Research methodologies for engineering asset management.

- Jardine (2013) Maintenance, replacement, and reliability: theory and applications. CRC press.

- Verner JM, Sampson J, Tosic V, Bakar NA, Kitchenham BA (2009) April. Guidelines for industrially-based multiple case studies in software engineering. In Research Challenges in Information Science, Third International Conference 313-324.

- Honert V (2013) Correlating the content and context of PAS 55 with the ISO 55000 series. South African Journal of Industrial Engineering , 2: pp. 24-32.

- Senevi K, Fitzgerald A (2006) Case study approach in operations management research.

- Sheng M (2014) Electricity Distribution (CICED), 2014 China International Conference on. Shenzhen, IEEE.

- Moteff (2004) Critical infrastructure and key assets: definition and identification, Library of congress Washington DC congressional research service.

- Srinivas Kumar P, Pintelon L, Vereecke A (2006) An empirical investigation on the relationship between business and maintenance strategies. International Journal of Production Economics 1: 214-229.

- Abowitz (2009) Mixed method research: Fundamental issues of design, validity, and reliability in construction research. Journal of Construction Engineering and Management

- Lawler EE (1985) Doing research that is useful for theory and practice. Lexington Books.

Citation: Bruiners J, Njuguna J, Agarwal A (2020) A Novel Research Approach for Whole-Life-Cycle Electrical Power Systems Asset Management Using Retroductive Case Study Method. Innov Ener Res 3: 234 DOI: 10.4172/2576-1463.1000234

Copyright: © 2020 Bruiners J, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited

Select your language of interest to view the total content in your interested language

Share This Article

Recommended Journals

Open Access Journals

Article Tools

Article Usage

- Total views: 2362

- [From(publication date): 0-2020 - Jul 03, 2025]

- Breakdown by view type

- HTML page views: 1588

- PDF downloads: 774