PROSPECTS FOR IMPROVING AND LIBERALIZING THE BANKING LEGISLATION OF THE REPUBLIC OF UZBEKISTAN AT THE PRESENT STAGE

Received: 17-Apr-2021 / Accepted Date: 22-Apr-2021 / Published Date: 19-May-2021 DOI: 10.4172/2169-0170.1000268

Abstract

The banks of Uzbekistan had to go through a long evolutionary path of development, overcome considerable difficulties to become an important system that affects the national economy today. In strengthening the banking system, the legislative framework is important, and therefore the study of development priorities is relevant.

The purpose of this article is to develop proposals and recommendations for further liberalization and harmonization of banking legislation, simplification of the procedure for participation of foreign banks in the banking system of the Republic of Uzbekistan, strengthening the legal status of banks.

The results of the study show that the banking legislation is not systematized, integration into the international banking system is weak, and the Central Bank of the Republic of Uzbekistan has broad administrative powers. The implication of the research is that strict legal norms and prohibitions against foreign banks make the banking sector of Uzbekistan not attractive. This study can be used as a reference point for the liberalization and harmonization of banking legislation in Uzbekistan.

Keywords: Banking supervision, The liberalization of the legislation, Foreign banks, Accredited representative offices

Introduction

The development of international economic and trade relations generates a rapid inflow of financial funds and monetary capital. Banks have an essential role in this process, and they are the driving mechanism of a country’s economy. Commercial banks are the stimulating agents of a market economy and active participants in investment projects. In this regard, the number of banks around the world is growing, while their activities are not limited by one country. According to statistics, there are currently 5,256 banks in the USA, 798 in China, 622 in the Russian Federation, 301 in the United Kingdom, and 247 in Switzerland [1]. As of 2020, 30 banks are operating in Uzbekistan, 13 of which are under state ownership and 17 are private, whereas the share of state ownership in assets and equity of banks amounts to 86%.

Drastic economic and political reforms implemented in Uzbekistan are directed at the construction of a new economic model, the foundation of which could include not only a multitude of ownership forms, competition, deregulation and equality, but also a modern banking system. In this context, measures to improve the banking system are undertaken in the Republic of Uzbekistan [2]. The Strategy of Actions on five priority directions of development of the Republic of Uzbekistan for 2017-2021 includes such matters as “deepening of reforms and ensuring sustainability of the banking system, levels of capitalization and deposit base of banks, strengthening their financial stability and reliability, further expansion of lending to promising investment projects as well as small and medium business entities.” Therefore, research is crucial in the area of banking operations, lending issues, and the role of the banking system in implementation of significant investment projects.

Banking legislation has a significant legal and economic impact, so it needs to be improved to a greater extent. Over the past period of independence, three versions of the Laws of the Republic of Uzbekistan "On Banks and banking activities" were adopted, which indicates the instability of the legislation [3].

In Uzbekistan, the banking legislation consists of many regulatory legal acts, the main part of which is the resolutions of the Board of the Central Bank of the Republic of Uzbekistan. According to statistics in the National Database of Legislation of the Republic of Uzbekistan at the beginning of February 2021, the Central Bank of the Republic of Uzbekistan for the years of independence adopted only 1509 departmental acts, of which 913 or have lost their force, only 596 departmental acts are in force [4].

One of the significant problems is the ban on the establishment of branches of foreign banks in the territory of the Republic of Uzbekistan, in connection with which foreign banks can protect their interests in the territory of the Republic of Uzbekistan only by opening accredited representative offices. However, the current legislation imposes very strict requirements for the accreditation of representative offices of foreign banks, which is reflected in the weak interest in the implementation of foreign banks ' activities in Uzbekistan.

The existence of the above-mentioned problems requires the adoption of non-urgent and comprehensive measures, starting with the harmonization of legislation, ending with the improvement of the banking system as a whole [5].

Literature Review

The idea of universal banking activity has been developing in parallel with banking specialization. That is the regular pattern of global banking community development. It is generally assumed that specialization helps banks increase the quality of client servicing and reduce costs of banking products. The idea of specialization is more common for US banks [6] (Lavrushina, 1998).

Experience of many leading countries shows that banks can develop with respect to both versatility and specialization. In both cases banks can earn good profits and only clients can answer which line of development will be more advantageous.

Expanding the commercial banking network and granting licenses enabling banks to carry out settlements on export and import operations instigates a necessity not only to increase the level of banking automation, but also to develop communication networks in the Republic of Uzbekistan and a connection to global telecommunication networks [7]. This task is being solved both independently at the regional level and by way of connection to the largest communication network in the world provided by the Society for Worldwide Interbank Financial Telecommunication (SWIFT).

This addresses the challenge of developing prompt, reliable, effective, confidential and secure telecommunication servicing for banks and standardizing forms and methods of financial information exchange.

The process of forming a wide range of services to offer banking clients has been underway in recent years. The execution of various banking operations is an essential feature of modern-day banking activity in all countries with developed banking systems [8]. Leading commercial banks in Uzbekistan strive to carry out a broad range of operations and services for their clients in order to expand their revenue base, and increase their rate of return and competitiveness. At the same time, it is important to consider that the development of banking activities assumes the provision of banking services with minimum costs for clients and the bank itself and the use of acceptable pricing for services required by clients.

Along with performing conventional banking services for clients – attracting cash deposits, providing loans and conducting cash management and payment servicing – modern banking institutions in Uzbekistan are starting to carry out online services and perform marketing research at clients’ request, foreign currency operations, information and inquiry advisory, operations with securities, etc.

According to Lexis V., banking services exhibit a number of common properties:

– cannot be carried out for future use;

– are of a productive nature;

– capital serves as the object of banking services;

– cover active and passive operations;

– are not provided solely by banks;

– may be classified as non-banking operations (Lexis V., 2000)[9].

The restructuring of the economic mechanism, orientation of the national economic strategy toward market relations, and a focus on expanding the diversity of ownership forms gave rise to a need for new, modern-day banking practice financial instruments – securities in the form of shares, bonds, promissory notes, etc. – as well as an active securities market. Securities are monetary and commodity documents with a common property [10] – they must be presented in order for the rights expressed in them to be exercised. Securities such as government and regional bonds, shares, promissory notes, savings and certificates of deposit, cash and prize lottery tickets are currently operating in Uzbekistan.

Banking operations with securities are divided into active and passive operations. In turn, active operations of banks with securities can be provisionally divided into two major groups: accounting and lending operations and investment operations. The first group comprises operations on accounting of promissory notes, providing loans against promissory notes and commodity documents, mortgage loans, and loans against securities. The second group of active operations with securities consists of arbitrage operations of banks at own cost with the aim of making a profit due to the exchange rate difference.

Historically, banks are most sensitive to the development of information technologies. Changes occurring at the “bank - client” level can be characterized as follows: from bank cards (1969 – emergence of cards with a magnetic strip) [11] to a teletext system (beginning of the 1980s) and other methods of remote management of a bank account (home banking) (Elinor Harris Solomon, 1987) to Internet/online banking and eventually Internet banks in their pure form (Security First Network Bank, Wingspan Bank, Juniper, CompuBank, etc.), [12] which use only online channels for servicing clients (Gracheva, 2001).Information about the distribution of Internet banks by region According to the marketing service Qualisteam is shown in Table 1.

| Region / country | Number of Internet banks |

|---|---|

| Africa | 23 |

| North America: Canada USA | 1395 32 1363 |

| Latin America | 258 |

| Asia | 174 |

| Europe: Germany France Italy other European countries | 1205 355 172 228 450 |

| Asia-Pacific region | 32 |

Table 1: Information about the distribution of Internet banks by region According to the marketing service Qualisteam.

The number of Internet users receiving banking services continues to grow rapidly and this growth, according to the majority of analysts, will increase even more in the future.

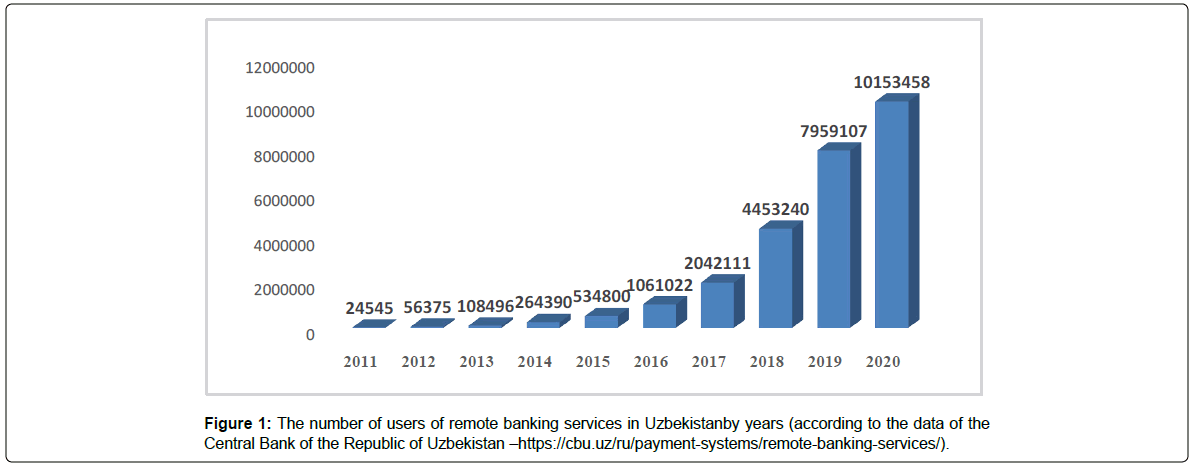

Figure 1 shows the number of users of remote banking services in Uzbekistan by years (according to the data of the Central Bank of the Republic of Uzbekistan

Figure 1: The number of users of remote banking services in Uzbekistanby years (according to the data of the Central Bank of the Republic of Uzbekistan –https://cbu.uz/ru/payment-systems/remote-banking-services/).

In total, according to self-reported estimates of Qualisteam [13], almost 95% of Internet banks around the world are included here (3,107 websites - http://www.qualisteam.com).

The market for online banking applications (http://www.idc.com) is also developing and such applications are attractive for banks aiming to increase their profits through new clients (particularly remote clients). According to IDC, the sales volume of online banking applications in the USA amounted to $93 million in 1998. Growth of sales of this software up to $326 million was expected in 1999. Such strong growth of the online banking apps market can be explained by the ever increasing presence of the Internet in all spheres of life. This urges banks to start competing for clients in the open-for-all environment. Thus, increasing numbers of banks are offering Internet banking services to their clients (Glinskikh A., 2000).

As noted by Glinskikh [14], the development of Internet banking will go through three main stages. The first stage provides for client access to bank accounts and the ability to conduct operations by telephone or online. Interactive technologies such as online bill payment and personalized reminders of the client’s account status are used during the second stage. Personal finance management functions such as receiving credits, implementing secure trade transactions and formalizing insurance policies are offered at the third stage.

Solonin B. specifies that the provision of services by banks through remote management of accounts via the Internet shall be referred to as online banking – Internet banking [15].

Internet banking described by Petrov S. as a prototype of an online bank, i.e. a new interactive technology that allows clients to be served without their physical presence [16].

In fact, Internet banking is a logical extension of such forms of remote banking as PC banking (using a personal computer to access an account via a modem connection with the banking network), telephone banking (servicing of accounts via telephone) and video banking (interactive communication between client and bank personnel).

The above types of banking are combined under the term “electronic banking services”. This is the most commonly used term in the literature and it characterizes all forms of access to the relevant banking services (Birkelbach, 1998). Electronic banking services is understood as being a collection of technological procedures and contractual conditions ensuring implementation of bank operations and other transactions by electronic means (Litvinenko A., 2000).

Despite the extensive use of Internet banking and the range of offered services, the majority of authors believe that Internet banking is not a separate service [17], but rather a continuation of normal banking services, albeit in a different environment (Gracheva, 2001).

With regard to banking supervision, a separate direction is being formed in the activities of central banks and other supervisory authorities: control over the functioning of information banking systems, ensuring information security and risk management tools are used in the process of providing electronic banking services (Rud’ko- Silivanov V.V., Afanas’ev A.A., 2001).

With respect to regulation of banking relations in the Republic of Uzbekistan, it is important to underline the fact that the domestic banking system went through the way of development including in terms of its legal support. Taking into account the extraterritorial character of information technologies and the dynamics of computerization processes, it is necessary to provide an appropriate and effective legal basis in the banking sphere. It should be noted that the lawmakers undertook separate efforts of legal regulation of analysed legal matters.

It is required to mobilize the legislative process to the maximum extent in order to optimize legal support of the mentioned processes. [18] These measures will allow significant easing of the implementation of the digital economy in the transition to open market relations and of the integration of the national economic system in the global reengineering processes of the economic relations system. Therefore, improvement of the legal regulation of the newest banking services by implementing innovations and up-to-date information and communication technologies is a high priority.

Generalization of the Main Statements

This study analyzes banking legislation and statistical data on the development of a range of banking services.

Based on the analysis of the legal literature in the previous part of this article, it is possible to distinguish different points of view on the concept, status and ways of improving the activities of commercial banks.

S.S.Gulyamov, who devoted his works to the legal foundations of corporate governance, provides for the consideration of commercial banks as a joint-stock company – a commercial legal entity. He pointed out that according to the banking legislation of the Republic of Uzbekistan [19], banks are created, as a rule, in the form of a jointstock company on the basis of any form of ownership. Consequently, the provisions of the Law of the Republic of Uzbekistan “On Joint-Stock Companies and Protection of Shareholders' Rights” apply to banks in the form of a joint-stock company (Gulyamov S.S., 2018).

Tran Q.T., Dang A.T., Le X.T. on the example of banks in Vietnam indicate that banks as a special kind of joint-stock companies require the formation of an effective system of corporate governance. Indeed, in banks, shareholders, members of the bank's Board and managers are given the most possible freedom of action to manage the bank (Tran Quoc Thinh, Dang Anh Tuan and Le Xuan Thuy (2021).

Consideration of corporate governance issues is not entirely effective, as the main focus is on the organizational and legal form of banks and the management of the bank itself, while the development of the banking system is also influenced by the quality of legislation.

The issues of improving the banking system, mainly in theory, are considered by scientists through the prism of foreign banks. It is in the status of foreign banks that the influence and effectiveness of banking supervision and the quality of banking legislation are traced. Dragomir L. in PhD thesis defined that foreign banks are considered a complex or group of legal entities [20] – a foreign bank and its subsidiary bank in a foreign country; compared a foreign bank to a multinational corporation, so it is used in many European countries (Dragomir L., 2010). By creating subsidiaries in various countries, foreign banks are interconnected with them through contractual structures. Banks use corporate and contractual forms of investment to legalize legal relations with subsidiaries from different jurisdictions. The lack of transnational approach is that the presence of banks in the legal fields of various states does not allow to include them in a single set of legal regulation, as the country has the ability to control a subsidiary of a foreign bank, not having “leverage” effect on bank-founders. However, foreign banks are not subject to legal regulation.

Danthine Jean-Pierre, Giacazzi Francesco, Vives Xavier, Ernest- Ludwig von Thadden suggest considering a foreign bank as a bank whose authorized capital is the object of investment. Foreign banks, creating a subsidiary bank or a bank with foreign capital, act as an investment entity. Thus, a foreign bank is both an object and a subject of investment legal relations (Danthine J-P., Giacazzi F., Vives X., von Thadden E-L., 2000). [21] This approach is very promising and can be applied in the future, as it more closely reflects the civil status of commercial banks, especially foreign banks.

In this article, emphasis was placed on analysis of the following aspects of the improvement and harmonization of banking legislation:

- problems in the interaction of the banking system subjects of the Republic of Uzbekistan;

- improvement of the legal status of foreign banks in the Republic of Uzbekistan.

This article analyses the statistical data of the banking sector of the Republic of Uzbekistan and developed countries, in particular the countries of Central Europe, which in the 1990s had the same economic development results as Uzbekistan. This ensures that growth rates are acceptable for Uzbekistan.

Discussion

Greater independence should be granted to banks and the banking system in Uzbekistan.

The legislation of the Republic of Uzbekistan allows the Central Bank to establish certain requirements for banks, ranging from registration and licensing, ending with the establishment of requirements for the corporate governance of banks. Also, the relationship of banks with users of banking services is also determined by the Central Bank. The liberalization of the rules regarding the authority of the Central Bank in respect of banks with foreign capital is the most important first step. Confirmation of information about the bank's location under the control of the supervisory authority at the place of its location and registration should be a sufficient condition for opening a foreign bank on the territory of Uzbekistan. [22] Licenses to foreign banks should be issued on the basis of openness and transparency. At the same time, it is necessary to legislate a ban on the submission of additional requirements, including in the departmental regulatory act of the Central Bank. This state of affairs will simplify the procedure for opening foreign banks and ensure the transparency of the banking system of the Republic of Uzbekistan.

As part of strengthening the guarantees of banking activities, it is necessary to transfer to the court the right to revoke the banking license on the grounds provided for by law. Such a procedure will protect banks, including foreign banks, from the subjective mistakes of officials, who can destroy the banking business on formal grounds, without taking into account the essence of what is happening. In any case, the process of legal proceedings presents the parties (in this case, the bank) [23] with the most complete protection mechanism.

Improvement of the legal status of foreign banks in the Republic of Uzbekistan

One of the essential issues in the development of the banking sector is improvement of the legal status of foreign banks in the Republic of Uzbekistan. As of today, 30 banks are operating in the Republic of Uzbekistan, seven of which participate with foreign capital: JSCB Savdogar, JSCB Hamkorbank, JSC KDB Bank Uzbekistan [24], JSC Ziraat Bank Uzbekistan, a subsidiary of the bank Saderat Iran in Tashkent, Tenge Bank, and the digital bank JSCB TBC Bank.

Table 2 as below Gives the Information on the main indicators of foreign banks in Uzbekistan as of November 1, 2020.

| № | Name of the bank | Asset | Credit | Capital | Deposit | ||||

|---|---|---|---|---|---|---|---|---|---|

| amount | share in % of total | amount | share in % of total | amount | share in % of total | amount | share in % of total | ||

| 1 | JSCB Hamkorbank | 9 819 | 2,8% | 7 236 | 2,7% | 1 402 | 2,4% | 3 438 | 3,3% |

| 2 | JSC KDB Bank Uzbekistan | 6 214 | 1,8% | 906 | 0,3% | 653 | 1,1% | 5 536 | 5,3% |

| 3 | Tenge Bank | 1 238 | 0,4% | 779 | 0,3% | 357 | 0,6% | 64 | 0,1% |

| 4 | JSCB Savdogar | 1 162 | 0,3% | 822 | 0,3% | 181 | 0,3% | 661 | 0,6% |

| 5 | JSC Ziraat Bank Uzbekistan | 988 | 0,3% | 541 | 0,2% | 311 | 0,5% | 474 | 0,5% |

| 6 | Subsidiary of the bank Saderat Iran in Tashkent | 393 | 0,1% | 6 | 0,0% | 360 | 0,6% | 30 | 0,03% |

| 7 | JSCB TBC Bank | 210 | 0,1% | 0 | 0,0% | 210 | 0,4% | 0,03 | 0,0% |

| billion soums | |||||||||

Table 2: Information on the main indicators of foreign banks in Uzbekistan as of November 1, 2020 (https://cbu.uz/ru/statistics/bankstats/422902/).

Banking legislation has a number of challenges in the regulation of activities of foreign banks. One of them is the complexity of the requirements for the establishment of foreign banks and accreditation of their branches. To establish a foreign bank, in addition to the general requirements it is also mandatory that the applying foreign bank has been operating in its own country for at least five years, and that it has a solid reputation and stable financial position with short-term obligations rated at least A1 (or A+), [25] as per the classification of credit rating agencies IBCA, Moody’s or Standard and Poor’s. Similar requirements are set for accreditation of representative offices of foreign banks. Accreditation is given for a period of no more than three years. These strict requirements, even if they arise from the need to maintain competitiveness of local banks and stability of the national banking system, to a certain extent prevent an increase in the share of financing by foreign banks, attracting foreign investments and development of the banking sector in general. In our opinion, in the course of establishing foreign banks, accreditation time should be extended and granting preference should be provided for with respect to those banks that already have accredited representative offices in the territory of the Republic of Uzbekistan or that have participated in the authorized capital of local banks.

The next key issue is to review the matter of permission for foreign banks to open branch offices. According to the Law of the Republic of Uzbekistan “On banks and banking activities”, establishment of branch offices by foreign banks in the Republic of Uzbekistan is not allowed. It should be noted that a branch has broader authorities than a representative office. [26] Thus, a bank’s branch office is a separate business unit performing banking activity on behalf of the bank that established the branch. A representative office of a foreign bank is a separate business unit representing its interests but not performing banking operations.

The prohibition of the opening of branch offices by foreign banks is substantiated mainly by two reasons:

1. to maintain competitiveness of national banks and demonstration of protectionism;

2. the risk of problems with conflict-of-laws regulation (jurisdiction of the founding state).

It is hard to agree with these arguments. The establishment of branch offices does not violate the competitive environment and rather encourages better provision of banking services. Competitive positions of a bank (i.e. its ability to retain and increase its market share) are determined by a range of factors: quality of promoted bank products and services in the market, appeal of price conditions of banking operations, ability of the bank to increase its volume of operations in response to expansion of the market demand, and the degree of confidence toward a bank on the part of market participants.

It should be noted that globalization processes taking place from the beginning of the 21st century induce mobility of foreign bank capital and its movement to new markets, above all to the banking sector of developing countries.[27] Namely, financial liberalization was the result of effective activities of foreign banks and increased foreign capital that allowed the opening of branches of foreign banks and provided an opportunity for transformation of resident banks into foreign banks in some countries. Statistics show that the percentage of banking assets that belong to foreign banks in certain Central European countries, e.g. Slovakia, increased from 24.10% at the end of the 1990s to 95.96% in the beginning of the 2000s, and Poland saw an increase from 17.4% to 70.9% of the total assets of commercial banks (Tulin D.V., 2006).

From an economic point of view, operations of foreign banks’ branches have a number of positive aspects:

- foreign banks are the most stable in crisis situations. According to statistics for 2016-2018, assets of foreign banks in the Russian Federation such as Raiffeisenbank, Rosbank, and Citibank have increased by more than 25%, while the indicators of national banks have been increasing at lower rates (5% or 10%) [28];

- foreign banks are the most competitive in terms of enhancing the quality of services and reduction of their costs, therefore they ensure the greatest realization of banking interests of natural persons and legal entities and improve the efficiency of the banking system. As the experience of countries such as Croatia, Slovakia, Slovenia and the Czech Republic shows, an increase in the share of foreign banks was accompanied by the growth of the banks’ efficiency (including on matters of bank deposits) by one and a half times and twice in general (L.G. Efimova, 2016).

- foreign banks have lower loan restrictions for users. Statistics show that loans of more than USD 1 million are provided by Sumitomo Mitsui Banking Corporation (Japan)[29], Vneshekonombank (Russia),Aktif Bank (Turkey) and others, as Table 3 below. Gives the Information on loans allocated by foreign banks of Uzbekistan

| № | Name of the bank | Total loans | from them | |

|---|---|---|---|---|

| individuals | legal entities | |||

| 1. | JSCB Hamkorbank | 7 236 | 1 946 | 5 290 |

| 2. | JSC KDB Bank Uzbekistan | 906 | 13 | 893 |

| 3. | Tenge Bank | 822 | 239 | 584 |

| 4. | JSCB Savdogar | 779 | 73 | 706 |

| 5. | JSC Ziraat Bank Uzbekistan | 541 | 29 | 512 |

| 6. | Subsidiary of the bank Saderat Iran in Tashkent | 6 | 4 | 1 |

| 7. | JSCB TBC Bank | 0,0 | 0,0 | 0 |

Table 3: Information on loans allocated by foreign banks of Uzbekistan as of November 1, 2020 (https://cbu.uz/ru/statistics/bankstats/422898/).

- activities of foreign banks are accompanied by improved risk management systems and introduction of innovative financial instruments and corporate bank management methods.

Consequently, the economic component of the permission to open foreign banks branches represents the most favourable condition for development of the banking sector of a country.

Conclusion

The analysis in this article allows us to conclude that it is necessary to take comprehensive measures to improve the legal regulation of the banking system in the Republic of Uzbekistan. The concept of legal regulation of the banking sector should be revised toward further liberalization that corresponds to the need for development of a market economy and fits well in the general direction of reforms aimed at liberalization of economic and political processes. When regulating the activities of foreign banks, the norms of investment legislation should be applied on a par with the legislation in the field of banking activities, which will ensure an increase in the efficiency of attracting investment in the banking sector.

Banking legislation should be specific and effective, as the reflection of numerous issues in subordinate acts disrupts the efficiency of banking legislation provisions. It is necessary to revise the excessive rule-making activity of the Central Bank of the Republic of Uzbekistan and clearly indicate the limits of regulation.

At the same time, the list of issues to be legally governed by the Central Bank of the Republic of Uzbekistan shall be specified in the legislation. To protect the rights and interests of commercial banks, in particular foreign banks, it is necessary to abandon the administrative procedure for revoking bank licenses and transfer the right to make a decision on revoking a license from the Central Bank of the Republic of Uzbekistan to the court.

Improving the participation of foreign banks requires fixing as a legal norm (a) the form of participation of foreign banks in the banking sector of the Republic of Uzbekistan, (b) the application of investment legislation in relation to banks with foreign capital, which will contribute to the development of the banking sector, attracting foreign investors to the banking sector, as well as (c) improving the activities of accredited representative offices by increasing the accreditation period from three to five years, (d) permission to establish branches of foreign banks.

References

- Birkelbach J (1998) Cyber Finance—Finanzinformationenim Internet. In Cyber Finance. Gabler Verlag, Wiesbaden. 185-245.

- Sayfullovna ML, Tulkunovna TN, Yashnarovna IM, Anvarovna ZF (2020) Science and Education: Strategic Interaction Republic Of Uzbekistan and Russian Federation. ИндуÑтриальнаÑÑкономика. 2.

- Dragomir L (2010) European prudential banking regulation and supervision: the legal dimension. Routledge. 5.

- Solomon E, editor. Electronic funds transfers and payments: The public policy issues. Springer Science & Business Media; 2013 Apr 17.

- Avramović S, Brenner SW, Butler WE, Caianiello M, Chan PC, et al. Kazan University Law Review.

- Antonov AA (2011) Realisation of Human Super-Intelligence: Developmental Learning. WSEAS Transactions on Advances in Engineering Education 8(4):109-119.

- Yakubiv V, Sodoma R, Hrytsyna O, Pavlikha N, Shmatkovska T, et al. (2019) Development of electronic banking: a case study of Ukraine. Entrepreneurship and Sustainability Issues 7(1):219.

- Arzumanova L, Gracheva E, Sitnik A, Tkachenko R (2020) Legal Regulation of Organizational and Financial Support of Mega-Science Projects. Financial Law Review. 29(3):1-9.

- Kurpayanidi K, Abdullaev A, Ashurov M, Tukhtasinova M, Shakirova Y (2020) The issue of a competitive national innovative system formation in Uzbekistan. InE3S Web of Conferences (Vol. 159, p. 04024). EDP Sciences.

- AP BI, Belykh LP, Blanka IA, Bora M, Voronina D. The speech for the defense of the diploma" Improving the methods of assessing credit risk": example, sample, free, download. Financial risks of the bank: classification, assessment, management Analysis of assets and liabilities of CJSC" Transcapitalbank.

- Babaeva GY, Nazarova VI, Murodova SN (2018) Procedure for opening and maintaining bank accounts in the Republic of Uzbekistan. World Scientific News 91:130-137.

- Pagett HE. Understanding the settlement of Balanusamphitrite through the molecular and structural characterisation of the settlement-inducing protein complex (Doctoral dissertation, Newcastle University).

- Johnson JE (1997) A fistful of rubles: Institutional change in the Russian banking systems, 1987-1996. Princeton University.

- Burkhanov A (2020) Indicators to assess financial security of the banks. ÐрхивнаучныхиÑÑледований. 11(27).

- Afanasev AA, Kasyanov VF, Lukmanova IG, Silka DN (2015) Synchronization of processes related to economic activity with stages of development of spatially-organized systems. International Journal of economics and financial issues. 5(3S).

- Clark TH, Lee HG (1998) Security First Network Bank: a case study of an Internet pioneer. InProceedings of the Thirty-First Hawaii International Conference on System Sciences 4:73-82. IEEE.

- Peterson DJ (2005) Russia and the information revolution. Rand Corporation 28.

- Toepfl F, Litvinenko A (2018) Transferring control from the backend to the frontend: A comparison of the discourse architectures of comment sections on news websites across the post-Soviet world. New Media & Society 20(8):2844-2461.

- Siahaan E (2017) Antecedents of employee performance and the influence on employee job satisfaction in banking service sector in Indonesia. Banks & bank systems 12(4):75-89.

- Borisov AM (2014) On the issue of interpretation of the “object†category in legal studies. Actual problems of Russian law (3):323-329.

- Ono S (2008) Efficiency of the Domestic and Foreign Banks in Russia. Economic Journal of Hokkaido University 37:29-43.

Citation: Gulyamov S, Khujayev S, Rustambekov I (2021) Prospects for Improving and Liberalizing the Banking Legislation of the Republic of Uzbekistan at the Present Stage . J Civil Legal Sci 10: 268. DOI: 10.4172/2169-0170.1000268

Copyright: © 2021 Gulyamov S, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Select your language of interest to view the total content in your interested language

Share This Article

Recommended Journals

Open Access Journals

Article Tools

Article Usage

- Total views: 3327

- [From(publication date): 0-2021 - Dec 02, 2025]

- Breakdown by view type

- HTML page views: 2375

- PDF downloads: 952