Review Article Open Access

Lessons for an Independent Scotland From Greece's Euro Tragedy

Lisa Tripp*Atlanta’s John Marshall Law School Atlanta, Georgia, USA

- *Corresponding Author:

- Lisa Tripp

Associate Professor

Atlanta’s John Marshall Law School Atlanta, Georgia, USA

Tel: 4048723593275

E-mail: ltripp@johnmarshall.edu

Received Date: June 23, 2014; Accepted Date: July 15, 2014; Published Date: July 17, 2014

Citation: Tripp L (2014) Lessons for an Independent Scotland From Greece’s Euro Tragedy. J Civil Legal Sci 3:128. doi:10.4172/2169-0170.1000128

Copyright: © 2014 Tripp L. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Visit for more related articles at Journal of Civil & Legal Sciences

Abstract

Scotland will soon decide whether to remain part of the U.K. or become an independent nation. Should Scotland choose independence, it may try to join a formal currency union with the U.K. or the E.U. This article focuses on the risks small nations can face in a currency union, as told through the prism of Greece’s experience in the Eurozone. Since the world financial crisis hit Europe, Greece has become the worst case scenario for small countries in a currency union. The austerity conditions the Troika requires in exchange for hundreds of billions in loans have caused a depression and unemployment crisis of historic magnitude in Greece, without reducing its debt. Greece would almost certainly be better off defaulting on its debt, but cannot do so in an orderly fashion because default would certainly mean a calamitous expulsion from the E.U. Greece is also something akin to a zombie democracy. All of the important decisions are effectively made by the Troika who have no electoral accountability to the Greek people. Joining a currency union always entails some loss of sovereignty and the benefits can certainly outweigh the risks. However, Greece shows that important aspects of national self-determination like tax policy, spending, interest rates, unemployment targets, pensions, work rules, etc., can be compromised if a country gives up its currency and is hit by financial calamity. These types of risks–ones that go to a newly independent country’s ability to function as a democratic state-are important risks to consider if Scotland chooses independence and chooses to join a currency union.

Keywords

Scotland; Independence; Austerity; Greece; Currency union; Troika; Eurozone

Introduction

Scotland will vote on September 18, 2014, to either remain part of the United Kingdom or be an independent nation. If Scotland chooses independence it will have to make many important decisions about its new government that will have enormous consequences for the type of nation an independent Scotland will become. One of the most important decisions Scotland will make is what currency to adopt. Will Scotland try to keep sterling, adopt the euro or adopt its own currency? Each decision carries with it serious risks and rewards.

The rewards of retaining the pound or adopting the euro are fairly obvious. The pound has been Scotland’s currency for centuries. It is also one of the strongest, stable currencies in the world. If Scotland takes the historic step of breaking with the UK, keeping the pound, a currency that has existed for over a thousand years, would make that break less jarring [1]. All of its contracts would stay in the same currency, there would be no risk of rapid, uncontrolled depreciation or appreciation that would undermine the economy of a new, independent Scotland, and currency speculators could not create instability in the currency for profit. Retaining the pound would also make leaving the UK less problematic in a sociological sense because the Scots have used sterling for so long, over 300 years, it is part of the Scottish national identity [2].

Although the euro is a new currency, it is also appealing because it is stable and used by many powerful European economies that would also be major trading partners of an independent Scotland. If Scotland were to use the euro, it would make travel and trade easier with many European nations and, like the pound, the euro is not prone to unpredictable fluctuations in value that could undermine a newly independent Scotland’s economy [3].

Although it is far from clear whether an independent Scotland could keep the pound in light of recent statements to the contrary from conservative and liberal leaders of the UK [4], or even want to adopt the euro in light of the ongoing political and economic crisis in the Eurozone [5], the virtues of retaining the pound or adopting the euro are apparent, but the risks for Scotland are many and not wellunderstood.

In order for Scotland to officially retain the pound or adopt the euro [6], Scotland would have to cede monetary sovereignty and enter into a currency union with the UK or the European Union. When a sovereign nation enters a currency union it gives up critical powers such as the power to print its own money, the power to set its own target interest and inflation rates, and the power to devalue its currency [7]. If the country is much smaller than other members of the currency union, as Scotland would be in either a pound-based or euro-based currency union, the risks are more pronounced.

In a pound-based currency union, for example, the Bank of England would make all of the key monetary decisions (setting interest rates to achieve target inflation and unemployment rates, determining how much money to keep in circulation, etc.) in the best interests of the union as a whole. These decisions directly impact economic growth, employment, the ability to pay debts, the strength of the currency relative to other countries’ currencies, which affects export competitiveness, among other things. Since England’s economy dominates the UK, the Bank of England would make monetary decisions that favor England, because what is best for England is best for the union, even if those same decisions were at the expense of Scotland’s economy.

For example, if the UK unemployment rate as a whole were 6.5 percent, but the Scottish unemployment rate were 8.5 percent, the Bank of England, all else being equal, would not lower interest rates to stimulate employment in Scotland because the unemployment target of below 7 percent would be met for the whole of the currency union. This would make it harder for Scotland economy to create jobs because the interest rates would be higher than what would be desirable for Scotland to stimulate investment and therefore jobs. But this would not matter to the Bank of England, because the target rate for the union as a whole would be met and there would be nothing Scotland could do about that.

As worrisome as it would be for a newly sovereign Scotland to cede such important sovereign powers at its nation’s rebirth, there is a more troubling concern. What would happen to a newly independent Scotland in a currency union if Scotland were to experience a financial shock that led to its inability to pay its debts to foreign or domestic creditors and be unable to borrow or tax to cover those debts?

One possible answer can be found in a country that is, like Scotland, famous for its literary tragedies. The real life tragedy that has befallen Greece since it experienced such a sovereign debt crisis while in the Eurozone is a cautionary tale for Scotland. Although most of the commentary about Greece’s economic hardship focuses on Greece’s well-known dysfunction (widespread tax avoidance, pervasive government corruption, a remarkably anti-competitive regulatory environment, anti-growth protectionist policies, arguably profligate spending on social welfare programs, etc.) the principle reason Greece is now a “failed state” suffering through a prolonged, historic depression is because Greece gave up its currency to join the E.U.. [8]

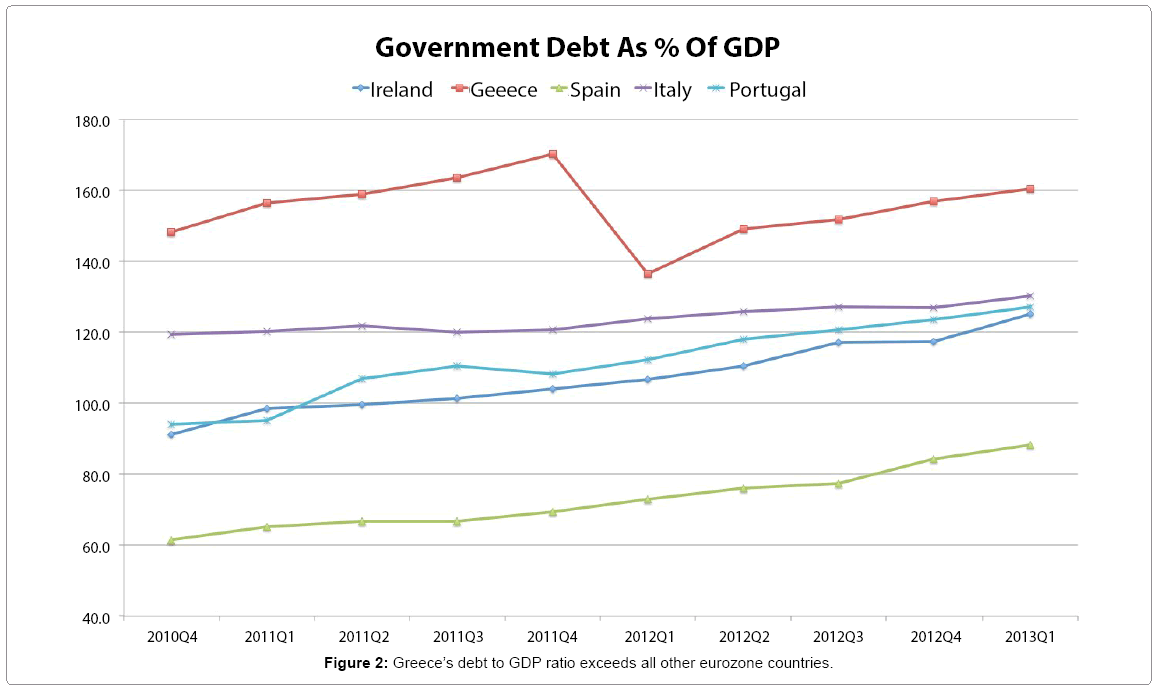

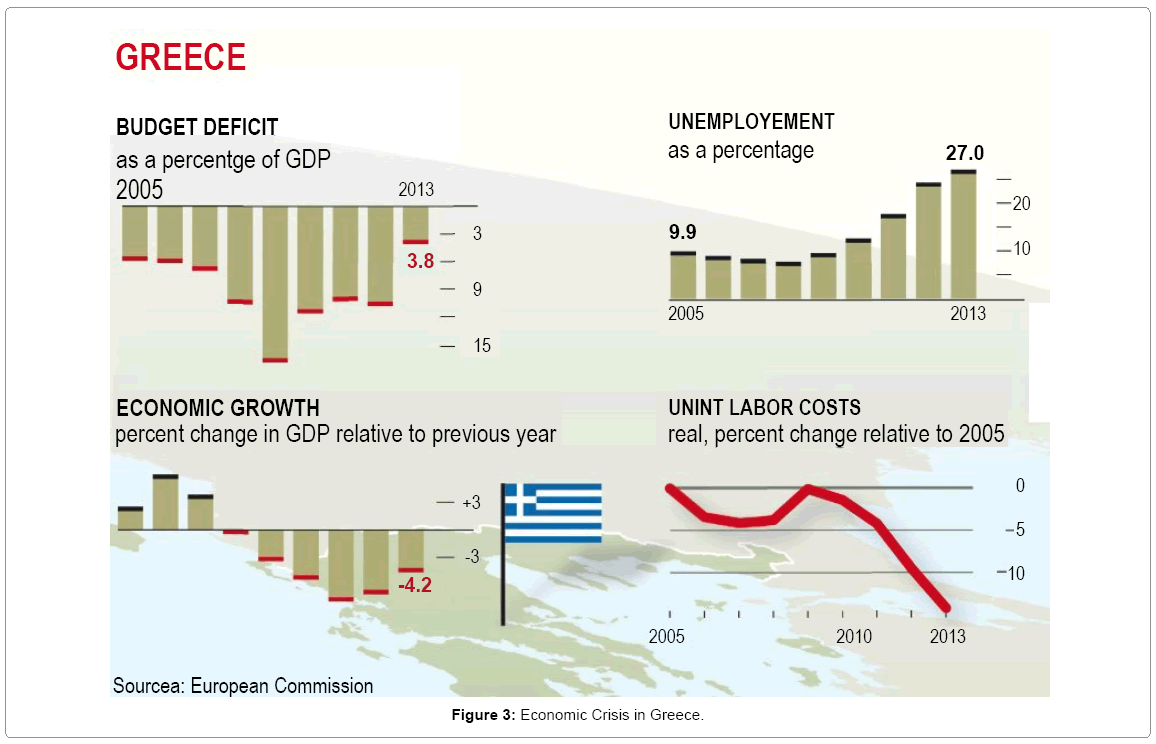

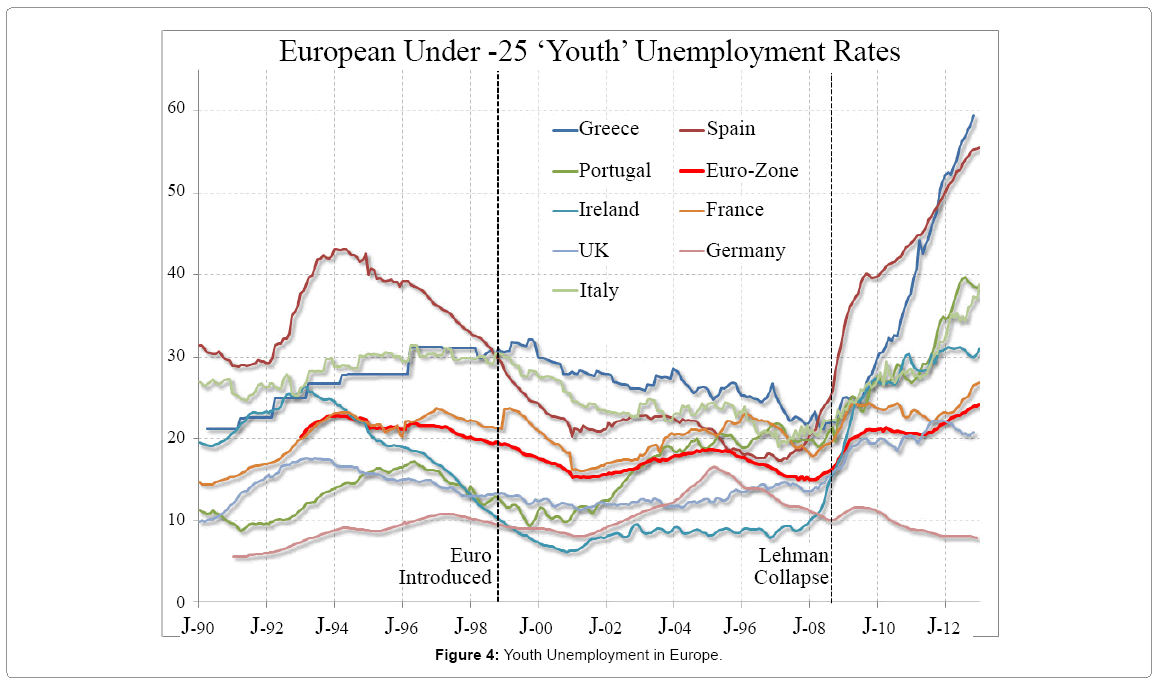

When, in the aftermath of the world financial crisis Greece became unable to pay its debts, Greece was forced to borrow money from its currency union partners or be thrown out of the union. Greece chose to stay in the union, and accept the austerity measures the Troika (the European Commission, the European Central Bank (ECB) and the International Monetary Fund (IMF)) demanded–massive tax increases and crippling spending cuts - in exchange for the billions it received [9]. The result has been ruinous for Greece. Unemployment in Greece at the start of austerity was 12.6%, now it is now over 25% [10]. Youth unemployment is close to a staggering 60% [11]. Greece’s youth is commonly referred to as a lost generation (this is also true in other so-called peripheral countries like Spain). Businesses have failed at astronomical rates; soup kitchen lines snake through Athens; George Soros is giving millions in heating oil aid and opening “solidarity centres” to help desperate Greeks in need of health care; some of the most desperate parents are leaving children at orphanages because they cannot feed them [12]. Suicide rates have doubled [13]. If Greece’s debts had shrunk as a result of the economic pain its citizens have endured, perhaps it would have been worth it. The debt load has not shrunk as a result of austerity, but its economy has. Greece’s economy has contracted by almost 25% since 2008 [14].

One might reasonably ask how the Greek government could continue to implement policies that have resulted in an explosion of joblessness, homelessness, increased suicide, and decimated its economy without making a dent in its debt. Greece has done this because not having its own currency has left it with something akin to a zombie democracy. The country has freely elected leaders, but the only real choice its elected officials have is to go along with the punishing austerity program or risk the social, economic and political calamity of losing the euro and being forced out of the Eurozone.

Unwilling to risk the consequences of leaving the Eurozone, Greece has ceded power to its Eurozone partners who are incapable of seeing austerity as anything but a moral and economic good, despite the historic amount of social and economic destruction austerity has caused the people of Greece. Because they are unelected, the Troika focuses only on budgets to the exclusion of every other indicator of social and economic health in Greece and they see success in the fact that Greece reached a budget surplus in 2014, while ignoring the suffering of historic proportion that was inflicted to meet these budget goals [15].

Should Scotland choose to enter a currency union with the UK or the E.U., it is not outside the realm of possibility that Scotland could find itself, as a small member of a large pound or euro-based currency union, in a position similar to what Greece has found itself in. This is particularly so when the Conservative party has long championed austerity policies and the Labour party appears to have capitulated and dropped its opposition to austerity. The E.U. is the prime proponent of austerity, even as E.U. unemployment has been at or above 12 percent for years and growth has been sluggish in the best of times since the financial collapse in 2008 [16].

The purpose of this article is to use the example of Greece to explain, in stark terms, the risks that Scotland faces should it become an independent nation without its own currency. In one sense, Cyprus, which had to borrow money from the Troika in 2012 to keep its banks from collapsing, would be a better object lesson for Scotland than Greece [17]. Cyprus, like Scotland, has two very large banks whose holdings dwarf the annual economic output of their home nation. When countries like Scotland and Cyprus have banks that are much larger than their economies it makes it very difficult for those nations to save their banking systems if a crisis were to befall them.

While there is no doubt that the experiences of Cyprus are relevant to Scotland, this article will focus on Greece, because the enormity of the tragedy in Greece reveals the true depth of the danger and independent Scotland could face if it joins a currency union with the UK or with the E.U.. This is not an argument against Scotland’s independence; it is an argument against an independent Scotland in a formal currency union.

This article is born out of a belief that the Greek experience under the euro holds important lessons for Scotland. It is also born of a conviction that neither the magnitude of the suffering in Greece or the primary cause of that suffering, Greece’s giving up of its own currency, are captured in scholarly literature or public discourse. Many who are interested in writing about the humanitarian disaster that has befallen Greece don’t analyze the role the euro has played in creating that suffering. On the other side, and with a few notable exceptions such as the Guardian’s coverage of Greece and the Eurozone crisis, the people who do understand the finance and currency aspects of the crisis don’t engage very much with the humanitarian side of things. This article hopes to help fill that gap by exploring the crisis in Greece and explaining in lay terms how sharing a currency is at the root of that crisis for the benefit of an independent Scotland, should one exist in the near future.

While this article advocates that Scotland not join a currency union, there are, of course, risks to adopting its own currency. Famous currency speculator, financier and philanthropist, George Soros, recently weighed in against Scotland adopting its own currency, explaining that would be “very inefficient and potentially dangerous because markets, currencies can be attacked and you can speculate against currencies [18].” An in-depth analysis of different currency options is beyond the scope of this article, but it is worth noting, even if only for history’s sake, that the currency brought to its knees by George Soros in 1992 was not a new currency, but was, in fact, the pound sterling [19].

This article begins its explanation of the dangers of a currency union by reviewing some of the historical factors that led to the creation of the euro, then explores the ways in which the euro takes important sovereign powers away from Greece, such as the ability to print money, the ability to deflate its currency to restore competitiveness, and the ability to set interest rates. The article then discusses how Greece’s democracy is impaired by austerity and its inability to dictate its own monetary policy because it adopted the euro. The article concludes with a discussion of the lessons Greece’s experiment with the euro could teach an independent Scotland.

The Path to the Euro: An Overview of Historical Reasons for Mid-Twentieth Century European Integration

In his speech accepting the 2012 Nobel Peace Prize, European Parliament President Herman Von Rumpuy addressed the audience with this reminder:

War is as old as Europe. Our continent bears the scars of spears and swords, canons and guns, trenches and tanks, and more. The tragedy of it all resonates in the words of Herodotus, 25 centuries ago: “In peace, sons bury their fathers. In war, fathers bury their sons.” Yet, after two terrible wars engulfed the continent and the world with it, finally lasting peace came to Europe [20].

Although Europe has been awash in bloody conflict for centuries, World War II was catastrophic for the continent. World War II is the most deadly war in history. More than 55 million people lost their lives over the course of that war; most of them died in Europe. Many of Europe’s great cities lay in ruins. Warsaw in 1945 was “a field of rubble [21].” The aftermath of this historic war, coming so soon after WWI, set the stage for a real determination on the part of Europe for real and peaceful integration for the first time in the continent’s history.

At the same time that Europe was dealing with the fallout of the war, another threat to European unity was building. Stalin and the other leaders of the Soviet Union believed that a socialist revolution would sweep Eastern Europe and then eventually take over the entire continent, so Stalin began making plans for a Soviet takeover well before the war ended [22].

He had for example prepared . . . secret police forces for each of the countries before he arrived in those countries. Most notably in Poland he (began) recruiting policemen from the year 1939. Of course we’ve always known that he prepared and recruited organized communist parties from the time of the Bolshevik Revolution onwards. You also see which kind of institutions the Soviet Union was most interested in. For example, everywhere that the Red Army went, one of the first things they did was take over the radio station. They believed very much in propaganda, in the power of propaganda and they believed that if they just could reach the masses by what was then the most efficient means possible, namely the radio, then they would be able to convince them and then they would be able to take and hold power [23].

Churchill and Truman, though allied with Stalin against the Germans, were deeply suspicious of him and his motives. Telegrams sent by Churchill just before the end of the war and just after the war ended indicate concerns about the vacuum that would be left when American troops left and non-Soviet troops drew down. Just four days after the official end of the war, Churchill noted an “Iron Curtain” was coming down across Europe [24]. He would repeat that phrase in his famous speech a year later in Missouri [25]. The Soviet threat created an urgency for European unity that helped propel Europe into finally taking concrete steps toward integration [26].

The post-war period was also a time of unprecedented multinational political and economic cooperation across the world. The most important multinational body to date, the United Nations, was formed in 1945. The Council of Europe was formed in 1949. The postwar period also marked the beginning of extraordinary cooperation in international trade. The Bretton Woods system, developed from a meeting of delegates from 44 countries in New Hampshire in the summer of 1944, created a three-tier framework to advance international trade and monetary stability. “The meeting was born out of the determination by US President Franklin D Roosevelt and UK Prime Minister Winston Churchill to ensure post-war prosperity through economic co-operation, avoiding the economic conflicts between countries in the 1930s that they believed contributed to the drift to war.”

The Bretton Woods system established the International Monetary Fund to enforce fixed exchange rates that were linked to the dollar and to provide short-term loans to countries in need [27]. It also established the World Bank (officially the International Bank for Reconstruction and Development) to make long-term loans that would create sustainable investments in economies that had been harmed by the war [28]. A third organisation, the International Trade Organization, was rejected by the US Congress in 1947 [29]. In its stead, Bretton Woods created the General Agreement on Tariffs and Trade (GATT). GATT, established in 1948, was a provisional system that involved rounds of negotiations to agree on trade rules and to reduce tariffs and it resulted in tremendous increases in international trade. GATT was replaced by the World Trade Organization (WTO) in 1995.

Most importantly for Europe, the Marshall Plan resulted in aid of over 13 billion dollars ($130 billion in 2012 dollars) being given to European countries to stave off famine and to rebuild decimated parts of Europe [30]. The Marshall Plan helped stabilize the continent and also resulted in the creation of the Organization of European Economic Co-operation (OEEC). The OEEC was founded in 1948 by 16 countries and two European territories to supervise the rebuilding of Europe and to promote coordinated economic development and trade between countries. The OEEC was superseded by a world-wide body, the Organization for Economic Co-operation and Development (OECD) in 1961.

The Marshall Plan is widely regarded as a great humanitarian effort [31]. As George Marshall stated in his famous speech at Harvard University:

Our policy is directed not against any country or doctrine but against hunger, poverty, desperation, and chaos. Its purpose should be the revival of a working economy in the world so as to permit the emergence of political and social conditions in which free institutions can exist. Such assistance, I am convinced, must not be on a piecemeal basis as various crises develop. Any assistance that this government may render in the future should provide a cure rather than a mere palliative.

The benefits of the Marshall Plan accrued to the US as well in the form of increased power in the region, developing a market for US goods and helping to isolate the USSR [32]. The Marshall plan set the stage for European revival by providing mostly grant money to European nations that did not have to be repaid, including Western Germany [33]. In 1953, the United States forgave $2 billion dollars out of a total of $3 billion lent to West Germany, which put West Germany on the same loan terms as other Western European countries [34].

The European Union and its Euro-Driven Crisis

The post-war period was one of continued focus on integrating Europe around a common market and neo-liberal economic principles. The precursor to the European Union, the European Economic Community (EEC) was created by the Treaty of Rome in 1957. The Treaty on Rome helped create a common market by restricting the protectionist economic policies, forcing countries to coordinate exchange rate policies and to work together regarding matters that affected the common market as a whole [35,36]. The European Union was officially created in 1992, by the Treaty on the European Union (TEU), signed in Dutch city of Maastricht [37]. The TEU was big step toward further economic integration and political integration of Europe. It introduced the notion of European citizenship and the creation of the single currency, the Euro, which was created in 1999 and introduced in 2002.

Undoubtedly, one of the most significant achievements of the E.U. was the adoption of the Euro. As of January 2014, there are 18 countries that use the euro as their currency. The euro is probably the single-most important symbol of European unity [38]. In addition to being the most powerful symbol of European integration, the euro is also very important economically [39]. The single currency makes travel and trade between member states much easier [40]. It also makes borrowing easier, because banks are not limited to local markets [41]. These factors facilitate more trade, investment and development within the union. The single currency bloc also stimulates international trade because the economic strength and stability of the union countries is enhanced and therefore attractive to foreign investors.

The advantages of the single currency are well-known and are understood by the European public. Less well-known are the risks of a single currency. The adoption of the euro by the member states that use it involved the transfer of monetary powers and policy from those sovereign nations to the European Central Bank. Although, for the first decade of the euro, this was a net positive for the “peripheral economies” because they could borrow money so cheaply, and inflation was kept in check [42], the financial crisis has revealed the dangers of giving up the right of each country to construct a monetary policy that is in the best interest of its citizens. The critical powers lost by giving up monetary sovereignty include the power to print and create money, the power to devalue your currency to restore competitiveness and the power to set interest rates. In a non-crisis environment, these lost powers may not appear meaningful, particularly in relation to the benefits of a single currency. However, in a financial crisis, the loss of these powers takes some of the most important powers democratically elected officials normally exercise for their citizens and transfers them to unelected, foreign officials whose interests lie with other constituents.

The power to create and print money

The power to create and print your own money is one of the hallmarks of national sovereignty [43]. Governments that have the exclusive and unlimited power to create a sovereign currency are monetary sovereigns [44]. Governments such as the state of North Carolina or the city of Toronto do not create or print currencies and are not monetary sovereigns. The United States was not a monetary sovereign for its entire history [45]. “Prior to 1971, the US was on a gold standard. It had a sovereign currency, but did not have the unlimited ability to create that currency, since every dollar needed to be backed by a fixed amount of gold. No gold; no dollars.” Monetary sovereigns can adjust how much money they print according to current economic conditions.

When monetary sovereign nations do not have enough money to pay for government operations and obligations (debt payments, social welfare payments, etc.) they typically tax, borrow and/or print more money. If Greece were a monetary sovereign, it could print money and then lend that money to itself (in the form of buying its own bonds). The money it lent itself could be used to pay its creditors and finance its operations. This might result in inflation, but inflation could actually helpful in this situation, because it will allow countries to inflate their way out of debt. Inflation causes the value of goods and services to increase, but the debt does not increase with inflation, it stays stagnate. The sale of assets held over time in an inflationary environment results in more money at the sale, which can then be used to pay off the debt amount which is fixed and therefore didn’t rise with inflation.

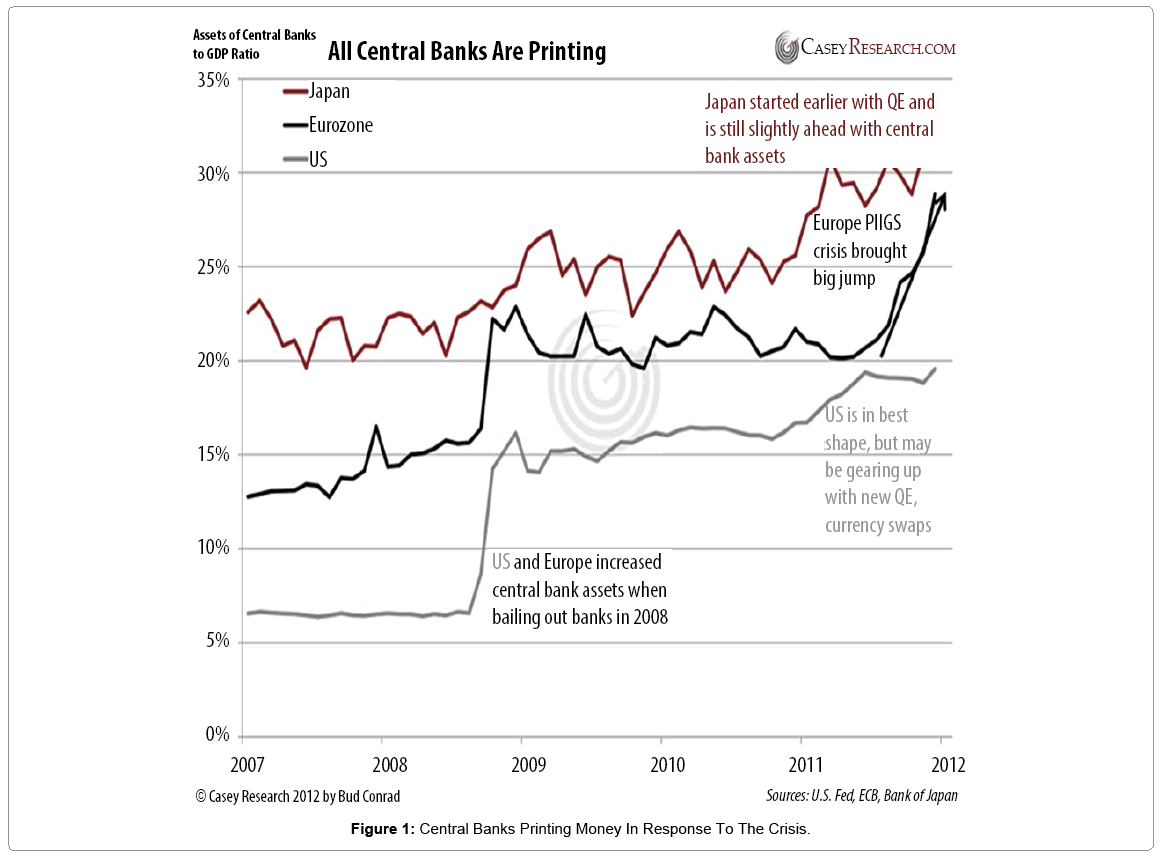

Of course it is impossible over the long run for a country with an unsound economy to print money to solve its problems because eventually hyperinflation would result if the money supply rose significantly, and its currency would become worthless and its economy would be in tatters. This is exactly what happened to Germany in the Weimar Republic. But, as a short-term response to a cataclysmic economic event like the financial crisis of 2008, the ability to freely print money, means the country will not have an acute liquidity crisis. Indeed, printing money has been one of the preferred methods of dealing with the recent economic crisis [46].

Because Greece cannot print its own money it was faced with two choices after its debt became untenable and it could not borrow because it was shut out of the bond markets [47]. Those choices were to default or take a loan package from the Troika (the IMF, ECB and European Commission) Figure 1. Although there is no legal mechanism by which countries can leave the European Union [48], a substantial default would almost certainly have meant expulsion from the European Union for Greece [49]. Technically, Greece has already defaulted on some of its debt [50]. In 2012, the Troika allowed Greece to impose losses on private bond investors (banks, insurance companies, investment funds, individuals) to take losses of 73-74%. The deal, known as a haircut in finance parlance, had private Greek bondholders exchange the bonds they purchased for new ones offering lower interest rates and longer maturities. The default did not include any loans made by the E.U. or IMF. If Greece were to refuse to pay back loans funded by E.U. taxpayers, it would be difficult to see a path in which the other member nations in the E.U. would allow Greece to remain part of the E.U.

There was and is almost no support within Greece for leaving the E.U. or dropping the euro as its currency. There are significant sociological and economic reasons the Greek people do not want to the leave the E.U. or the euro. On the sociological side, Greece is acutely aware that “the concept of a European identity originates from Ancient Greek and Roman civilizations where the ideals of free thought, humanism and democracy were first developed [51].” In that sense, Greece is at the very core of the European identity, since Greece is the birthplace of the core European values. On the other hand, as much as Ancient Greece is at the core of European ideals, modern Greece’s relationship to Europe, or European ideals is much more complicated.

Aside from the existential question of the Eurozone’s survival, what is at stake in the debt crisis is nothing less than the European identity of contemporary Greek society. This would be put to a severe test if Greece were to tumble out of the Eurozone and suffer the mother of all economic and social implosions.

Like people in other countries that lie on Europe’s fringes, such as Britain, Russia, Spain and Turkey, Greeks traditionally used to talk about “going to Europe” as if their country did not really belong to the continent. This world view was rooted in centuries of dark historical experiences.

From the Middle Ages until the 1821-1832 war of independence, Greece languished under Ottoman overlordship. No sooner was the nation reborn than Europe’s great powers imposed a teenaged Bavarian prince on Greece as its first head of state and demanded the repayment of onerous debts incurred during the fight for freedom.

But political and military disasters contributed to Greece’s sense of detachment from Europe, too. Ravaged under Nazi occupation in the Second World War, Greece then endured a civil war from 1946 to 1949 whose outcome – the crushing of a communist insurgency–was determined largely by British and US intervention.

After the collapse of a seven-year military dictatorship in 1974, Greece was welcomed into the old European Economic Community in 1981 partly because of the well-intentioned desire of older EEC countries to incorporate Greece once and for all as a member of a prosperous, democratic European club. As Valéry Giscard d’Estaing, the then French president, remembers, it was all about paying a historical debt to Greece as the foundation stone of European culture.

Now a generation of better-educated and, to some extent, bettertravelled Greeks has grown up, the first who are truly accustomed to thinking of themselves as Europeans [52].

Given this history, the near universal desire to stay in the Eurozone, at almost all cost, makes sense. There is also a significant economic case to be made for Greece staying in the Eurozone [53]. Economists have identified numerous negative impacts of Greece abandoning the euro and returning to the Drachma, including a lack of drachmas for months due to the time it takes to print them, confusion as to the status of millions of euros in contracts given there is no method for leaving the E.U. in the law, devastating real wage declines, deflation, hyperinflation and a run on the banks that would necessitate strict currency controls on how much money could be taken out of the banks and transferred out of the country [54]. Ironically, although currency controls are prohibited by Article 63 of the E.U. Lisbon Treaty [55], currency controls went into effect in Cyprus in March of 2013 as a consequence of its financial crisis and an E.U. bail out that imposed significant losses on bank depositors that held sums in Cypriot banks in excess of the insured amount [56].

Whatever the costs of leaving the E.U. and returning to the Drachma, the cost of staying in the E.U. has been devastating to Greece, and other countries, due to the Troika’s imposition of harsh austerity conditions in exchange for the bailouts. By any reasonable measure, austerity has not worked. It has not reduced Greece’s debt burden Figures 2-4.

Financial crises are invariably painful. The question is how the pain is distributed. Private investors lost substantial sums of money in the haircut on Greek bonds. The E.U. members and IMF contributors who are loaning Greece the bailout money in exchange for austerity face a risk of default, but so far, they insist on being paid back. So far, half of the bailout money provided has gone to pay off their debt [57].

The Greek people, however, have paid dearly. “Since 2009, salaries in the public sector have been cut up to over 50 percent, wages in the private sector have been reduced by 40 percent, and pensions have been cut up to 45 percent. From 2010 to 2013 (income taxes have) increased by 25 percent . . . real estate (taxes have) increased by 552 percent. The value added tax was raised from 19 to 23 percent, and numerous other indirect taxes have been added or gone up. In 2014, revenue from tax increases imposed on businesses is expected to increase by 137.2 percent [58].” There has been a 40% cut in hospital funding and alarming increases in incidents of HIV, TB and other communicable diseases, and the reemergence of malaria [59]. Poverty, suicide and homelessness have increased dramatically [60]. Golden Dawn, a farright, xenophobic, neo-Nazi party has emerged to win seats in the Greek parliament. It is not an overstatement to say that Greece’s society has been torn apart by austerity.

The power to devalue the currency

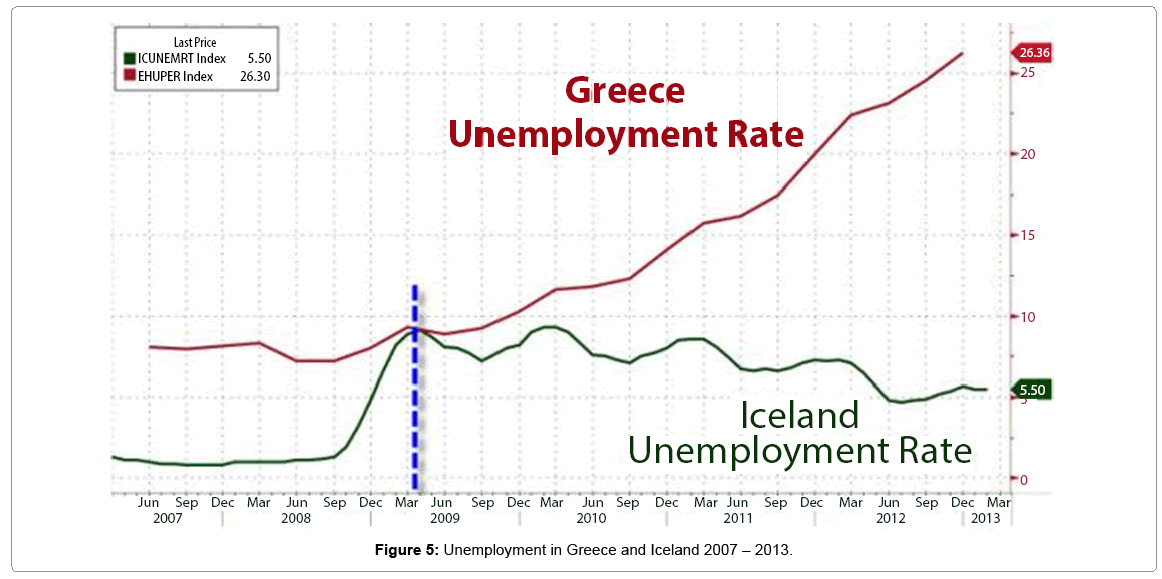

Another important power given up in exchange for the euro is the power to devalue currency. When a country controls its own currency, it can give itself competitive advantages over other countries by devaluing its currency Figure 5. A country with a devalued currency relative to its competitors can sell its goods abroad cheaper than another country. Just by virtue of the devaluation, it retains a competitive advantage and attracts more foreign money into its country.

For example, Greece and Italy and Spain all attract tourists because of their abundant natural beauty. If Greece had a weaker currency like the Drachma and Italy and Spain kept the euro, Greece would become an even more desirable vacation destination because it would be so much cheaper than Italy and Spain.

Also, Greece, Italy and Spain are exporters of olive oil. If Greece could price its olive oil in Drachmas and if Italy and Spain priced their olive oil in euros, the Greek olive oil would be much cheaper for the US consumer to buy because the Drachma would be much lower in value. So, if a bottle of Italian olive oil cost 5 euros that would cost the US consumer approximately $6.75 in US dollars because the dollar is weaker than the euro. In contrast, if Greece adopted the Drachma and sold a bottle of olive oil to a US consumer, that bottle of olive oil might hypothetically cost $2.50 US dollars because the dollar would likely be much stronger than the Drachma. Clearly there would be an incentive to buy more Greek olive oil and less Italian olive oil given those significant price differences and this would help Greece recover financially.

Greece cannot do this, of course, because it currently uses the same currency as Italy and Spain. So, the only way for Greece to get a competitive advantage over Italy and Spain in selling olive oil is for Greece to make the same olive oil cheaper. Greece can do this by becoming more efficient or by having its labour and manufacturing costs to shrink. While greater efficiency would be ideal, that is not what is happening in Greece. What is happening there is a long, slow and incredibly painful process of shrinking labour and manufacturing costs by lowering wages and the standard of living of the Greek people.

If Greece had kept its own currency, it might not still be in this historic depression. It might have been more like Iceland. Iceland was in the process of applying for E.U. membership when the 2008 financial crisis hit, so it still had its own currency, the Icelandic Krona. Iceland chose to default on its debt, not bail out the banks and it devalued its currency–all against the vehement opposition and political firestorm of its neighboring countries who stood to lost their investments [61]. Although Iceland went into economic depression for a time, it has since recovered and has an unemployment rate of 5.5% compared to Greece’s unemployment rate of 26.3%.

The power to set interest rates

Another important power countries that have their own currencies have is the power to set central bank interest rates that fit the needs of the economy as those needs change. For E.U. countries, there is only one central bank, the ECB, and the mandate of the ECB is to set interest rates that protect against excessive inflation and deflation (called price stability) in the Eurozone as a whole. Studies show that the ECB has achieved this aim [62]. However, setting rates that meet inflation targets for the whole Eurozone has not meant that the rates set are ideal for each member nation. In fact, economic analysis shows that the ECB’s interest rate moves have largely been in line with what economic conditions in Germany and France warrant, the two largest countries in the Eurozone, but not for other countries [63].

When interest rates do not fit the needs of an economy they can cause economic problems. Rates that are too high for the economic conditions, depress needed growth in the economy, because the cost of borrowing is too high. Rates that are too low for the economic conditions may cause the economy to overheat because low rates fuel excessive investment and then asset bubbles develop and then burst. For much of the time preceding the crisis, the ECB’s interest rates for Greece’s economy were almost certainly too low, while they are too high for Greece in the post-crisis economy.

Zombie Democracy

“The problem in Europe is that there is a government headed by one person (Angela Merkel, Chancellor of Germany), . . . That’s the issue and how to deal with it. All decisions are taken by one leader. This is what is happening now [64].”

At the heart of democracy lies the ideal that the power to govern comes from the people and those who govern are accountable to the people. “Voters must have the right to terminate the agency if the agent does not represent the voters to their satisfaction. Without accountability, there is no real consent of the governed and thus no real democracy [65].”

Since the financial crisis, the most important decisions affecting the Greek people have not been made by their elected representatives; they’ve been made by EC, ECB and IMF officials that have no accountability what-so-ever to the Greek people. Greece cannot print its own money, so it must go hat-in-hand and beg the Troika or risk default. Greece has a long history of defaulting on its debts, but now default is almost too risky to contemplate because of the unknown risks of being kicked out the E.U. and adopting another currency. Greece can’t devalue its own currency because it doesn’t control the euro. This means the only realistic way to restore Greece’s economic competitiveness is to impoverish the Greek people. Greece can’t set its own interest rates, it has to live with ECB interest rates set with other countries’ economies in mind. This makes Greece susceptible to both growth that is both too high and too low.

Because Greece gave up its monetary right of self-determination and adopted the euro, the pain suffered by the Greek people continues unabated, even as unemployment hits an astounding almost 30% and an entire generation’s hope of prosperity has been lost [66]. The Greek people can, of course, elect officials who could theoretically negotiate a better deal. However, this power is really illusory because Greece does not have exit leverage. A Greek threat to exit has too little meaning because Greece is arguably too economically small and too politically powerless to be perceived a real existential threat to the Eurozone. So the Greek people have two options: elect a government that does what it is told by the Troika or one that risks the chaos of abandoning the euro and departing the Eurozone [67].

To much of the world, Greece’s fate is a result of its own dysfunction. While Greece is fairly criticized for these things, they miss the mark in explaining what matters about this situation. What matters for Greece is that it is no longer truly democratic and no longer truly a sovereign state. Greece stopped functioning as a truly democratic state when the financial crisis of 2008 resulted in the need for a bailout of Greece’s government and that bailout required agreeing to the brutal austerity provisions that have crippled Greece and been met with indifference by the people who functionally run the country from Brussels and Frankfurt (home of the ECB). In an interview in January 2014, about the fact that George Soros had opened up charity centres in the hardest hit parts of Greece, sociologist Aliki Moriki said “Greece, to a great degree, has become a failed state. . . . It is unable to provide basic facilities for its citizens because of budget cuts. . . . In the absence of public welfare, and with around one and a half million officially unemployed, growing numbers are looking for substitutes (for social services) elsewhere [68].”

Lessons for Scotland From the Greek Experiment with the Euro

It might be tempting to conclude that because Scotland is so much wealthier than Greece, comparisons to Greece don’t really offer much relevant information for an independent Scotland. After all, according to the Scottish Government, counting its share of North Sea oil output, Scotland would be the 14th wealthiest nation among OECD nations and Greece is near the bottom at 29 [69]. This criticism is appealing on a superficial level, but fails because it assumes that relative wealth alone is sufficient to guard against insolvency in the face of a financial crisis.

An independent Scotland would be a relatively wealthy country, but its banking sector is so large relative to the size of its economy that a financial crisis could create a real solvency concerns. In fact, it would have been very difficult, if not impossible, for Scotland to have bailed out the Royal Bank of Scotland and Halifax Bank of Scotland in 20xx if it had been an independent country [70].

So the question remains, what lessons can Scotland learn from Greece’s experience in the Eurozone. The major lesson, in a broad sense, is that being a small country in a currency union with much larger partners carries significant risks. In non-emergency circumstances, Scotland would give up important powers that would directly impact its economic future. Scotland would not be able to set its own interest rates, which would impact its economic development. Scotland could not depreciate its currency to give itself an advantage in pricing its exports lower than its competitors it or make itself a more attractive tourist destination.

In a currency union with the U.K., the Bank of England would set interest rates and take measures that impact the value of the pound in ways that help England, because England is by far the largest economy in the union, even if those same decisions hurt Scotland. This is happening to Greece and several other Eurozone countries right now (Ireland and Spain) [71]. The ECB’s policies help keep the euro too strong for struggling economies, like Greece, Ireland and even France, but at healthy levels for Germany and other stronger economies within the Eurozone [72]. Certainly the current strength in the euro is due in part to confidence in the European economy since it came out of recession, but it is also due to the ECB rejecting quantitative easing (unlike Japan, England and the U.S.) out of concern it would cause inflation to exceed ECB goals, among other reasons [73]. The strong euro hurts Greece because almost 60 percent of its exports are to countries outside the Eurozone, so the price these consumers pay for Greek goods is higher when the euro is stronger [74]. This makes Greece’s exports less competitive and makes Greece weaker at a time when its economy desperately needs growth. Germany is less impacted by the strong euro because, although it is a leading exporter to non-Eurozone countries, its exports are higher-end and its products’ consumers are less price-sensitive [75].

These concerns are important, but probably the most important lesson from Greece comes from how it has ceased to function as anything but a zombie democracy since it came under the supervision of the Troika. Since being bailed out by the Troika, Greece’s essential democratic function–the Parliamentary system of law making–has been reduced to something akin to a caricature of democratic law making. Laws that relate to every aspect of Greek economic life are now made with virtually no input from the Greek Parliament–they are made by the Samaras government and the Troika. Procedurally, the Troika negotiates with the ruling coalition government and arrives at an agreement that will satisfy the Troika so that they will be willing to release tranches of bailout money to the Greek government so it can pay its bills [76]. Although the ruling government has extensive negotiations with the Troika, the Parliament is sometimes given just a few days to review, debate and then vote on the agreement. As one opposition party member put it, “How is it possible that the government was in negotiations with the troika for seven months and MPs will only be informed (about the bill) a few hours before the debate begins?”

When the government presents these bills to Parliament, it does so in large take it or leave it pieces, so as to minimize the chance for modification, which would have to be approved by the Troika, or rejection which could lead to Greece being kicked out the Eurozone [77]. The ruling government does not even try to hide that the fact that Greek MPs really have no choice but to accept the terms offered if they want Greece to keep the euro. Greece’s Health Minister issued a blunt warning in March of 2014, that “Anyone who votes against (the multibill) in Parliament will be held accountable for the country’s euro exit.”

In addition to process concerns, the Troika’s demands are breathtaking in their scope. According to the Financial Times:

European creditor countries are demanding . . . changes in Greek tax, spending and wage policies by the end of this month and have laid out extra reforms that amount to micromanaging the country’s government for two years. . . Changes demanded by the Troika] range from the sweeping–overhauling judicial procedures, centralizing health insurance, completing an accurate land registry–to the mundane– buying a new computer system for tax collectors, changing the way drugs are prescribed and setting minimum crude oil stocks [78].”

Other Troika demands include that “bread will be no longer sold by piece but it will be weighed in front of the consumer [79].” “Milk will be sold in three categories and respectively price ranges. “Fresh milk” tag will be scrapped and new tags . . . introduced.” Caps on prices for books will be scrapped except for books of literature. Pharmacies may open in other stores like supermarkets and will have to open six days per week.” According to Mutjtaba Rahman, Euro Analyst at the Eurasia Group, the Troika’s “programme is much, much more ambitious than economic reform, this is state building, as typically understood in traditional low-income contexts.”

The Troika has, for all intents and purposes, taken over Greece. One view is that Greece is lucky to have the Troika’s support. It has loaned Greece over $200 billion euros and without it Greece most certainly would have gone bankrupt. Another view is that the Troika is acting in the best economic interest of the Eurozone in general and Greece’s creditors in particular. That view suggests that it is more cost-effective for Germany and other Eurozone nations to loan Greece money,than absorb the costs associated with a Greek exit and the Eurozone instability that would create.

A very credible case can be made that Greece would have been better off defaulting and formally exiting the euro. The positive experience, relative to Greece and Ireland, that Iceland had with default is the best evidence for that argument. Greece also has a long history of default. According to noted Harvard economists Reinhart and Rogoff, Greece has been in default about half of the time that it has been an independent nation [80].

The reason Greece did not default was likely due to their presence in a currency union, given their long history of sovereign defaults. As odd as it may seem to the 21st century reader, if currency unions inhibit sovereign defaults in heavily indebted countries, that is actually another reason to be wary of joining a currency union. Reinhart and Rogoff published a working paper in January 2014 arguing that the extremely high debt cannot be managed through austerity; defaults were necessary to restore growth, even though the thought is anathema to policy-makers [81].

The IMF working paper said debt burdens in developed nations have become extreme by any historical measure and will require a wave of haircuts, either negotiated 1930s-style write-offs or the standard mix of measures used by the IMF in its “toolkit” for emerging market blowups. “The size of the problem suggests that restructurings (defaults) will be needed, for example, in the periphery of Europe, far beyond anything discussed in public to this point,” . . . The paper said policy elites in the West are still clinging to the illusion that rich countries are different from poorer regions and can therefore chip away at their debts with a blend of austerity cuts, growth, and tinkering (“forbearance”). The presumption is that advanced economies “do not resort to such gimmicks” such as debt restructuring and repression, which would “give up hard-earned credibility” and throw the economy into a “vicious circle”. But the paper says this mantra borders on “collective amnesia” of European and U.S. history, and is built on “overly optimistic” assumptions that risk doing far more damage to credibility in the end. It is causing the crisis to drag on, blocking a lasting solution. “This denial has led to policies that in some cases risk exacerbating the final costs,” it said [82].

Greece seems to be case in point for the Reinhart and Rogoff analysis. Years of punishing austerity have not resulted in growth, but in economic collapse. Because the Greek economy has been free-fall, debt has not been reduced and remains at debilitating levels for Greece. If all of the trappings of being in the euro currency union resulted in Greece not defaulting when it arguably should, this is a risk of entering a currency union that Scotland should consider before joining such a union.

Another risk of joining a currency union is that the union’s rules on budget deficits can hinder the ability of member nations to combat unemployment. Indeed, certain E.U. rules are likely exacerbating unemployment problems in the Eurozone [83]. In currency unions like the E.U., countries can lose the ability to effectively set a target unemployment rate. This is because of a combination of (1) members being required to keep adhere to budget deficit guidelines and (2) the way the EC determines whether a given countries budget deficit is structural or cyclical. Budget deficits are caused by natural dips in the economic cycle (cyclical) or by fiscal policies that result in too much state spending, too little taxation or both (structural). If a country is running an unacceptably high budget deficit, and that deficit is structural, then austerity–tax increases and government spending cuts–are the appropriate response. If the budget deficit is cyclical, then it is assumed that it will be temporary and austerity measures are not needed.

The key to determining how much of a countries’ budget deficit is structural or cyclical lies in calculating the country’s “natural unemployment rate” and comparing it to the country’s actual unemployment rate. If a country’s actual employment rate is at or close to its natural unemployment rate, then that economy is humming along at close to full capacity, so any deficits must be a function of too much spending, too little taxing or a mixture of both.

This seems reasonable, but the problem lies in the way the E.U. calculates natural unemployment. In essence, the E.U. calculates a country’s natural unemployment rate by extrapolating it from recent past performance of the labor market. In countries that have endured massive job losses in a short period of time, like Greece and Spain, the EC views these countries’ historically high unemployment rate as normal, which creates a bias for continued high unemployment in countries hit hardest by the financial crisis.

Take Spain as an example. Using the method of calculating natural unemployment by looking at recent years’ unemployment rates, the EC considers 23% to be Spain’s “natural unemployment rate” in spite of the fact that from 1987-2013, Spain’s unemployment rate was much, much lower-17% [84]. Spain’s actual unemployment rate as of May 2013 was 26.90%. If Spain’s actual employment rate (26.9%) is very close to its natural employment rate (23%), then it is close to full employment and most of its budget deficit is a function of spending too much and taxing too little, rather than output gaps that occur in normal cyclical economic variation. If that is the case, unemployment is not a problem in Spain, but the budget deficit is, and more tax increases and spending cuts are needed to close the budget deficit.

If this seems like an absurd way to evaluate structural deficits, natural unemployment and the need for austerity, many nations agree, as did a technical panel advising E.U. finance ministers [85].

A group of countries led by Spain argued this made little sense and should be changed. The new methodology will lower estimates of the “natural” unemployment rate for crisis-hit countries, meaning that it will need to drop sharply for the economy to be considered operating at full potential. “Everything being equal, this will increase potential growth estimates for these countries, especially for Spain, and therefore reduce the structural deficit,” Mr. Lebrun said, who chairs the Output Gaps Working Group. The new methodology proposed by Spain could halve its estimated structural deficit this year and cut it by two-thirds next year, according to the Spanish finance ministry. That could mean a significant reduction in the amount of austerity that the beleaguered Spanish public would have to endure.

It was expected that the EC would adopt the technical panel’s recommendation as a matter of course, but, in a surprise decision, senior finance officials refused to adopt it, possibly for political reasons.

The importance of this concern for a newly independent Scotland cannot be overstated. Joining a currency union could mean that, in addition to all of the other losses of freedoms described in this article, Scotland could be prevented from doing what governments around the world have done since the beginning of modern economic systems. Scotland could be prevented from making employment and economic growth their primary concerns, even if Scotland were experiencing an employment and growth crisis of historic proportion.

Conclusion

Should Scotland choose independence, the decisions it makes about what currency to use will have lasting impacts on the new nation. For much of the run up to the independence vote it was assumed by many that Scotland would keep the pound and enter into a currency union with the U.K. if the yes vote prevailed. That belief was shattered when the entire political establishment in London - David Cameron (Conservative), Nick Clegg (Labour) and Ed Miliband (New Democrat) - announced they were all opposed to sharing the pound with Scotland.

This may prove to be an auspicious turn of events for Scotland. Currency unions provide benefits, but they deprive countries of important monetary policy powers and, in acute financial crises, they can undermine the very reasons Scotland sought independence in the first place–the right of self-determination. Scotland may in fact choose to take that risk, but it should do so with a full appreciation of the risks of being a small part of a much larger currency union.

References

- Kit D (2001) A History of Sterling. The Telegraph

- Marshall A (2014) Georgia Osborne Is Right: Scotland Under Sterling Is Not Truly Independent

- Christian H (2013)A Legal Analysis of the Euro Zone Crisis. 18 Fordham J. Corp & Fin. L. 519, 521.

- Douglas F (2014) Scottish independence: Economist criticises currency union rejection

- See generally Hoffmann (n 3).

- Scotland could unofficially adopt the pound or the euro as its currency, just as Panama, Ecuador and El Salvador use the US dollar as their currency without the permission of the United States. Some commentators, such as Sam Bowman, Research Director of the Adam Smith Institute argue that this would be the best decision for Scotland. “An independent Scotland that used the pound as its base currency without the English government’s permission, with banks continuing to issue notes privately and private citizens free to choose any currency they wanted, would probably have a more stable financial system and economy than England itself.”

- http://www.adamsmith.org/news/press-releases/comment-an-independent-scotland-would-be-better-off-using-the-pound-without

- Thomas P and Troeger VE (2004)External Effects of Currency Unions

- Lauren M (2012) The Greek Debt Crisis: The Weakness of an Economic and Monetary Union

- ibid at 267-268.

- http://www.europarl.europa.eu/news/en/news-room/content/20140129STO34108/html/Greece-Troika-success-story-or-a-warning-against-too-much-austerity

- Ping CS (2013)Greek youth unemployment soars to 64.9pc

- Helena S (2014)George Soros funds ‘solidarity centres’ to help Greeks hit by economic crisis

- Helena S (2011) Greek Woes drive up suicide rate

- Phillip Iand Helena S (2012) Greek economy to shrink 25% by 2014

- See Macias (n 8) 267.

- http://epp.eurostat.ec.europa.eu/statistics_explained/index.php/Unemployment_statistics

- See Hoffman (n 3) 527.

- Michael S (2014) George Soros says euro most viable option for Scotland

- Sebastian M (2010) More Money Than God: Hedge Funds and the Making of a New Elite. Penguin Press,Germany

- www.consilium.europa.eu/uedocs/cms_data/docs/pressdata/en/ec/134126.pdf

- Bob E (2012) Interview with Anne Applebaum, Columist.

- Vladmir D (2012) How Communism Took Over Eastern Europe After World War II: An Interview with Anne Applebaum.The Atlantic

- ibid.

- www.chu.cam.ac.uk/archives/gallery/Russia/CHAR_20_218_109.php

- www.winstonchurchill.org/learn/biography/in-opposition/qiron-curtainq-fulton-missouri-1946/120-the-sinews-of-peace

- http://news.bbc.co.uk/2/hi/7725157.stm

- www.imf.org/external/about/histcoop.htm

- Steve Schifferes (n. 27).

- www.wto.org/english/thewto_e/whatis_e/tif_e/fact4_e.htm

- www.marshallfoundation.org/TheMarshallPlan.htm

- www.nobelprize.org/nobel_prizes/peace/laureates/1953/press.html

- www.humanrights.dk/human+rights/europe,+enlightenment+and+rights/the+european+council/the+history+of+the+european+council?print=1

- Jonathan ES (1995) Foreign Debts to the U.S. Government: Recent Rescheduling and Forgiveness.

- Harvey BF (2002) New Forms of Governance: Ceding Publis Power to Private Actors: Public Policy and the Private Sector in Audiovisual Industries.

- http://europa.eu/legislation_summaries/institutional_affairs/treaties/treaties_maastricht_en.htm

- http://ec.europa.eu/economy_finance/euro/index_en.htm

- http://harvardmagazine.com/2013/07/anatomy-of-the-euro-crisis

- ‘The Euro’ n. 42.

- www.eubusiness.com/topics/euro/business

- For a member state to adopt the Euro, it needed to satisfy the European Monetary Union (“EMU”) convergence criteria: (1) high degree of price stability, (2) sustainable government finances, (3) proper exchange rates, and (4) long-term interest rates.

- Makris M (2012) The Case for Greece Staying in the Eurozone,Greek Economists for Reform

- Claus DZ (2013)The Concept of Monetary Sovereignty Revisisted. 24 European Journal of International Law.

- http://mythfighter.com/2010/08/13/monetarily-sovereign-the-key-to-understanding-economics

- George JW (2010) In Defense of the Civil Law: A Response to Hayek.

- Cody DP (2013) The Rules Of The Game For Eurozone Debtors: Will The 21st Century See Effective Reform Or Financial Calamity? 47 Int’l L 137: 140-41

- http://seekingalpha.com/article/821871-its-not-just-greece-spain-is-now-printing-euros

- www.imf.org/external/np/exr/facts/pdf/europe.pdf

- www.dw.de/greek-creditors-receive-official-haircut-notification/a-15767530

- www.openeurope.org.uk/Content/Documents/Pdfs/Greece_better_off_out.pdf

- http://emes.pspa.uoa.gr/upl/Identity.pdf

- www.ft.com/intl/cms/s/0/cdca041hhc-060e-11e1-ad0e-00144feabdc0.html?siteedition=uk#axzz2qrJ8vmZf

- RauolRuparel and Mats Persson (n 63).

- Anders A (2012) Why Greece Must Not Leave the Euro Area

- www.theguardian.com/money/2013/mar/29/10-lessons-cyprus-bailout

- Charlemagne (2013) The Cyprus Bailout: A Better Deal, But Still Painful

- Andy D (2013) Where Did Greece’s Bailout Money Go

- Jon H (2012) Greece on the breadline: HIV and malaria make a comeback

- Lianna B (2012) Poverty, Homelessness and Suicide: Greek Citizens Bludgeoned by Austerity, International Business Times

- http://www.theguardian.com/world/2013/oct/06/iceland-financial-recovery-banking-collapse

- http://econ.berkeley.edu/sites/default/files/Srivangipuram.pdf

- http://www.ecb.europa.eu/stats/money/long/html/index.en.html

- www.theguardian.com/world/2014/jan/08/greece-begins-eu-presidency-austerity-intolerable

- George AN (2009) Wethe People: The Consent Of The Governed In The Twenty-First Century: The People’s Unalienable Right To Make Law. 4 Drexel Law Review 319: 329.

- http://www.huffingtonpost.com/constantine-tzanos/where-is-the-rule-of-the-_b_4490896.html

- Additional analyses of the democratic deficits that exist for Greece are presented in Section V, Lessons for Scotland from the Greek experiment with the euro.

- www.theguardian.com/world/2014/jan/21/george-soros-funds-solidarity-centres-greece-economic-crisis

- http://www.scotland.gov.uk/Resource/0044/00446013.pdf

- http://www.theguardian.com/politics/scottish-independence-essential-guide#204

- http://blogs.marketwatch.com/thetell/2013/11/06/how-a-strong-euro-could-strangle-the-regions-recovery

- http://lajeunepolitique.com/2013/02/08/is-the-rise-of-the-euro-hurting-european-economies

- http://www.independent.ie/business/world/ecb-open-to-quantitative-easing-says-bundesbank-30125108.html

- http://soberlook.com/2012/08/who-really-benefits-from-weak-euro.html

- Eric R (2013) A soaring currency hinders recovery in euro zone

- http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_26/03/2014_538480

- http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_27/03/2014_538491

- http://www.ft.com/intl/cms/s/0/fde0e3d4-5e3b-11e1-85f6-00144feabdc0.html?siteedition=intl#axzz1n2tUh4yi.

- http://www.keeptalkinggreece.com/2014/03/28/draft-bill-to-overhaul-greek-trading-regulations

- Tony B (2011) ‘Greece’s European identity at stake’

- http://www.imf.org/external/pubs/ft/wp/2013/wp13266.pdf

- http://www.businessinsider.com/imf-paper-reinhart-rogoff-western-debt-defaults-2014-1

- Mathew D (2013) Europe’s Austerity Hangs in Budget’s Balance’

- Joana T (2014) Spanish Unemployment Rate at 26% in Q4 2013. Trading Economics 23

- Mathew D (2013) Austerity Seen Easing With Change to EU Budget Policy. The Wall Street Journal 19

- Mathew Dalton (2013) EU Balks at Rule Change That Could Ease Austerity. The Wall Street Journal 24

Relevant Topics

- Civil and Political Rights

- Common Law and Equity

- Conflict of Laws

- Constitutional Rights

- Corporate Law

- Criminal Law

- Cyber Law

- Human Rights Law

- Intellectual Property Law

- International public law

- Judicial Activism

- Jurisprudence

- Justice Studies

- Law

- Law and the Humanities

- Legal Philosophy

- Legal Rights

- Social and Cultural Rights

Recommended Journals

Article Tools

Article Usage

- Total views: 14810

- [From(publication date):

November-2014 - Aug 30, 2025] - Breakdown by view type

- HTML page views : 10243

- PDF downloads : 4567