Research Article Open Access

Health Insurance Coverage and Utilization of Health Services among Educated Urban Citizens of a Developing Country

Adil SO1*, Akber S1, Sheikh H2 and Mustafa MW3

1 School of Public Health, Dow University of Health Sciences, Pakistan

2 Department of Statistics, University of Karachi, Pakistan

3 Institute of Health Management, Dow University of Health Sciences, Pakistan

- *Corresponding Author:

- Syed Omair Adil

School of Public Health

Dow University of Health Sciences, Pakistan

Tel: 92-3322319119

E-mail: omair.adil@duhs.edu.pk

Received date: July 27, 2016; Accepted date: September 23, 2016; Published date: October 03, 2016

Citation: Adil SO, Akber S, Sheikh H, Mustafa MW (2016) Health Insurance Coverage and Utilization of Health Services among Educated Urban Citizens of a Developing Country. J Community Med Health Educ 6:469. doi: 10.4172/2161-0711.1000469

Copyright: © 2016 Adil SO, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Visit for more related articles at Journal of Community Medicine & Health Education

Abstract

Background: Easy access to healthcare is a challenge for developing countries. This study aims to determine the health insurance status and utilization of health services among educated urban citizens of Pakistan. Methods: An online survey was conducted and 700 individuals with a minimum of 14 years of education were contacted via emails and messages on social media. Google spread sheet was used to gather all the information. Participation was completely voluntary and anonymous. Information was collected regarding health insurance coverage, reasons for not availing health insurance, monthly health expenditure, problem incurred in getting treatment from a doctor and hindrance in getting medicine in the last 12 months. Results: The response rate was 14.14%. A majority i.e. 30.3% of the participants worked in private companies. Among 44.8% of the study participants, the most common reason behind non-health insurance coverage was financial. The odds of having health insurance coverage was 4.94 times higher in people who faced problem in getting treatment from a doctor in last 12 months than those who did not face problem (AOR: 4.94, 95% CI: 0.33-72.46). In addition, the odds of health insurance coverage was found 14.17 times higher in people who had problem in getting medicines in last 12 months than those who did not had any hindrance (AOR: 14.17, 95% CI: 1.02-197.35). Conclusion: The present survey showed significant financial obstacles in accessing health coverage among individuals with no health insurance. Most of the people who had health insurance were those who have faced problems in getting medical treatment during the past 12 months. Effective health insurance reform and efforts to improve health insurance coverage is needed particularly in the developing countries.

Keywords

Health insurance status; Health services utilization; Educated urban citizens

Introduction

Health is a basic necessity from which no living life can be desisted as the growth of any country’s population is hugely affected by its health system and policies. According to World Health Organization (WHO), universal coverage of healthcare has a direct impact on health of its population. The goal of universal health coverage is basically to provide health services to all people without disposing them to financial obstacles particularly those who are paying for it [1].

Medical health insurance can be regarded as an integrated component of social health insurance which covers universal health coverage through possible organizational mechanisms. It basically stipulates healthcare for identification of diseases and for provision of health services primarily on basis of equity [2,3].

In low and middle income countries like Pakistan, high levels of out-of-pocket expenditure (O.O.P) is the foremost and an important issue that needs to be addressed [4,5]. Considering the fact, easy access to affordable health insurance is an essential need and utmost requirement in these countries.

Pakistan’s population was more than 188 million in 2015 which is equivalent to 2.56% of world’s total population. Despite of such alarming growth pace, the current spending on public health can be regarded as insufficient in Pakistan. Only 3.5% is spent on health and spending on public health is only 0.7% of GDP. Moreover, it is reported that social health covers only 5% of the population [6].

Ample number of research studies have emphasized to view health insurance coverage as a distinguished need [7-9]. In this regard, the role of care managers which includes health specialist, trained healthcare staff, and nurses can function effectively in fostering the need of healthcare reforms particularly in developing countries. A project conducted by Ciccone et al. has reported significant findings which states that resilient partnership between care managers and empowering patients can have positive impact on the health of patients [10]. The findings can be utilized to develop and implement stringent policies and reforms needed to make health insurance coverage accessible to everyone. The effective role of care managers in this regard is of added value.

Access to health services is one concept but access to universal health coverage stands against barriers related to poor understanding of health systems and lack of interest particularly in developing countries of the world. However, implementing health insurance reforms in developing countries is still a development issue. Designing and implementing health insurance reforms on basis of evidence-based practice requires a definitive health system framework which can allow universal health coverage to function within the health system by using approaches that can raise revenues so as to enable purchase of healthcare services. Considering this fact, it can also be assumed that by fostering implementation of such health insurance functions can contribute towards covering and reducing the healthcare cost as well as coverage of right health services to right people on basis of equity and justice. Although, there are numerous frameworks and healthcare models available but are linked to economic growth, decisive policy making accompanied with an increase in government spending on healthcare in the country [9,11,12].

Thus, evidence reflects that like other low and middle income countries, health insurance coverage is in its initial phases in Pakistan. Taking into account the facts and health system priorities in Pakistan, this study was mainly designed to assess the health insurance coverage and utilization of health services among educated urban citizens of Karachi, Pakistan.

Methodology

An online survey was conducted from July 2015 to September 2015 and 700 individuals with a minimum of 14 years of education were contacted via emails and messages on social media. Participation was completely voluntary and anonymous. Google spread sheet was used to gather all the information. All information collected was kept confidential. However, the information collected was regarding the health insurance coverage, reasons for not availing health insurance, monthly health expenditure, problems incurred in getting treatment from the doctor in last 12 months and about hindrance in getting medicine in last 12 months. Statistical package for social sciences (SPSS) version-20 was used for statistical analysis. Logistic regression model was used to determine the relationship of health insurance coverage with different variables. All variables with a p-value of less than 0.15 from univariate models were included in multivariate logistic regression so as to determine the most related factor with health insurance coverage among the survey participants.

Results

The overall response rate was approximately 14.14%. Baseline characteristics of the participants are shown in Table 1.

| n | Percentage (%) | |

|---|---|---|

| Age, years | 36 (24-50)* | |

| Gender | ||

| Male | 36 | 36.40% |

| Female | 63 | 63.60% |

| Monthly expense, in PKR | 3000 (1000-4500)* | |

| Occupation | ||

| Business | 6 | 6.10% |

| Doctor | 4 | 4% |

| Housewife | 15 | 15.20% |

| Labor | 3 | 3% |

| Private Job | 30 | 30.30% |

| Retired | 4 | 4% |

| Student | 25 | 25.30% |

| Teacher | 12 | 12.10% |

| n: number, *median (IQR), PKR: Pakistani Rupees | ||

Table 1: Baseline characteristics of the responders (n=99).

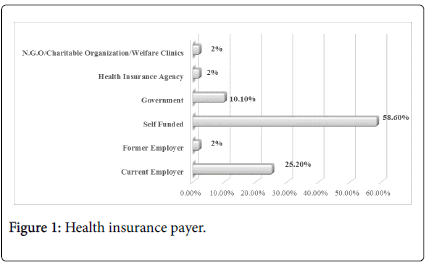

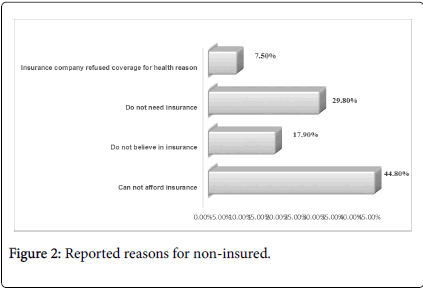

Mean age of the participants was 37.65 ± 16.01 years. Male preponderance was found to be higher i.e. 63.6% as compared to females which was 36.4%. A majority of the participants i.e. 30.3% worked in private companies followed by students 25.3% and housewife 15.2%. According to the reported health insurance coverage, it was found in only 32.3% participants (Figure 1). Self-funded insurance coverage was predominantly higher which was reported to be 58.6% in majority of the responders, followed by current employer 25.2% and in government employees 10.1% as per the findings. Mean monthly payment spent by non-health insurance participants was 2496.26 ± 2033.81 rupees. The reported reason behind non-health insurance coverage is shown in Figure 2. Out of 67 non-insured responders, financial obstacle was the most reported reason among 44.8% of the participants, while 29.9% reported that they do not need insurance, 17.9% reported that they do not believe in insurance and 7.5% reported that insurance company refused to provide coverage due to health reason.

Univariable analysis showed that odds of health insurance coverage was 59% more likely in males as compared to females (OR: 1.59, 95% CI: 0.67-3.77, p-value 0.293). The odds of health insurance coverage was 38.23 times higher in people who had difficulty in getting treatment from doctors in last 12 months than those who did not had any difficulty (OR: 38.23, 95% CI: 4.92-296.21, p-value<0.001). The odds of health insurance of coverage was 45.92 times higher in people who had hindrance in getting medicine in last 12 months than those who did not face any hindrance (OR: 45.92, 95% CI: 5.91-356.85, pvalue< 0.001). In multivariate analysis, two mostly reported reasons were included along with other variables which were: 1) difficulty in getting treatment from a doctor and 2) hindrance in getting medicine. The odds of health insurance coverage was 4.94 times higher in people who had difficulty in getting treatment from doctor in last 12 months than those who did not had any difficulty after adjusting for other variables (AOR: 4.94, 95% CI: 0.33-72.46, p-value 0.243). The odds of health insurance coverage was 14.17 times higher in people who had reported problem in getting medicine in last 12 months than those who did not had any hindrance in getting medicine after adjusting for other variables (AOR: 14.17, 95% CI: 1.02-197.35, p-value 0.048) (Table 2).

| Variables | Univariate Analysis | Multivariate Analysis | |||||

|---|---|---|---|---|---|---|---|

| OR | 95% CI | p-value | AOR | 95% CI | p-value | ||

| Age | 1.01 | 0.98-1.03 | 0.637 | - | |||

| Gender | Male | 1.59 | 0.67-3.77 | 0.293 | - | ||

| Female | 1 | ||||||

| Faced problem in getting treatment from doctor in last 12 months | Yes | 38.23 | 4.92-296.21 | <0.001** | 4.94 | 0.33-72.46 | 0.243 |

| No | 1 | 1 | |||||

| Faced problem in getting medicine in last 12 months | Yes | 45.92 | 5.91-356.85 | <0.001** | 14.17 | 1.02-197.35 | 0.048* |

| No | 1 | 1 | |||||

| OR: Odds Ratio, AOR: Adjusted Odds Ratio, *p-value <0.05, **p-value <0.0001 | |||||||

Table 2: Regression analysis for health insurance coverage (n=99).

Discussion

The results of our survey have revealed that majority of the study participants had noteworthy difficulty and hindrance in terms of availing and access to health insurance coverage. Among the total survey respondents, only a quarter were found to have health insurance. Considering the response rate of the participants, the results findings can be regarded as an underestimation of actual utilization of healthcare services among these educated citizens of Karachi.

According to the findings of this survey, health insurance coverage was predominantly found higher among men as compared to females which is in concordance to other research studies conducted earlier [13-15]. Although, in the developed part of the world, where health plans, healthcare act and reforms prevail, the gender rating regarding health insurance is also still debatable. It is however; stated that women tend to cost slightly more than men to get insured essentially which is attributable to expenses of maternity i.e. childbirth and care [16].

Considering the mode of health insurance coverage, a majority of the study participants reported to have self-funded health insurance which is also parallel to the findings of studies conducted among the developed countries around the globe [17,18]. Moreover, the findings of this study has also revealed that majority of the participants who had health insurance were those who had incurred hindrance in getting treatment by a doctor as well as have faced difficulty in getting medicines in the last 12 months.

In this study, those survey participants who had reported to have no health insurance coverage were further explored for all the probable reasons for non-health insurance. A majority of the study participants have reported financial obstacles for having no health insurance coverage which is similar to the findings of other studies [19,20]. Whereas, the remaining study participants who were non-insured were ambiguous about the certainty of health insurance coverage while a less than quarter of study participants had no believe in health insurance since they didn’t consider it as a need for themselves. Considering this fact, it can be stated that poor understanding towards health insurance coverage and deficiency in our health system leads to underutilization of healthcare services among people.

It is therefore important to design and implement health insurance on basis of evidence-based practice. Moreover, interventions and policies along with a definite political will are also needed in order to plan and design medical health insurance system principally for the people living in low and middle income countries [21,22].

Conclusion

The present survey showed significant financial obstacles in getting health coverage among individuals with no health insurance. It can be concluded that there is a dire need of efforts along with a convincing political will regarding affordable access of health insurance coverage to all people particularly in developing countries like Pakistan.

Limitation

As for this survey, study participants were mainly approached through emails messages. Therefore, use of questionnaire can be regarded as a limitation to this study. However, emails messages used for this survey comprised of structured and close ended questions.

References

- WHO (2015) Universal health coverage.

- Green M (2012) Understanding health insurance: A guide to billing and reimbursement. Cengage Learning.

- Abrejo FG, Shaikh BT (2008) Social Health Insurance: can we ever make a case for Pakistan. J Pak Med Assoc 58: 267.

- Acharya A, Vellakkal S, Kalita S, Taylor F, Satija A, et al. (2011) Do social health insurance schemes in developing country settings improve health outcomes and reduce the impoverishing effect of healthcare payments for the poorest people. A systematic review.

- Carrin G (2002) Social health insurance in developing countries: a continuing challenge. IntSoc Security Rev 55: 57-69.

- Asian Development Bank (2005) Technical Assistance to the Islamic Republic of Pakistan for the Developing Social Health Insurance Project. Islamabad.

- Gupta H (2007) The role of insurance in health care management in India. Int J Health Care Qual Assurance 20: 379-391.

- Cheng SL (2013) Changes in health insurance coverage of young adults from 2009-2010: Multilevel analysis using the medical expenditures panel survey (MEPS). APHA.

- Lagomarsino G, Garabrant A, Adyas A, Muga R, Otoo N (2012) Moving towards universal health coverage: health insurance reforms in nine developing countries in Africa and Asia. The Lancet 380: 933-943.

- Ciccone MM, Aquilino A, Cortese F, Scicchitano P, Sassara M, et al. (2010) Feasibility and effectiveness of a disease and care management model in the primary health care system for patients with heart failure and diabetes (Project Leonardo). Vasc Health Risk Manag 6: 297-305.

- Lancet T (2012) The struggle for universal health coverage. The Lancet 380: 859.

- Evans DB, Marten R, Etienne C (2012) Universal health coverage is a development issue. The Lancet 380: 864-865.

- Sabatino SA, Coates RJ, Uhler RJ, Alley LG, Pollack LA (2006) Health insurance coverage and cost barriers to needed medical care among US adult cancer survivors age< 65 years. Cancer 106: 2466-2475.

- Pear R (2012) Gender Gap Persists in Cost of Health Insurance. The New York Times.

- Sommers BD, Buchmueller T, Decker SL, Carey C, Kronick R (2013) The Affordable Care Act has led to significant gains in health insurance and access to care for young adults. Health Aff 32: 165-174.

- Graves L (2013) Why Making Women Pay More Than Men for Health Insurance Doesn’t Make Sense. National J.

- Fronstin P (2015) EBRI Education & Research Fund E. Notes: Self-Insured Health Plans. EBRI Notes 36: 1-29.

- Hofmann A, Peter R (2015) Selfâ┬?┬ÉInsurance, Selfâ┬?┬ÉProtection, and Saving: On Consumption Smoothing and Risk Management. J Risk Insur.

- Wiatrek DE, Morra M, Shaw B, Sharpe K, George R, et al. (2013) Documenting the Health Insurance Needs of Cancer Patients and Providing Scarce Resolutions. J Cancer Educ 28: 221-227.

- Govender V, Chersich MF, Harris B, Alaba O, Ataguba JE, et al. (2013) Moving towards universal coverage in South Africa? Lessons from a voluntary government insurance scheme. Global Health Action 6.

- Jooma R, Jalal S (2012) Designing the first ever health insurance for the poor in Pakistan--a pilot project. J Pak Med Assoc 62: 56-58.

- Sarwar A, Qureshi HA (2013) Awareness and Willingness to Buy Private Health Insurance and a look into its Future Prospects in Pakistan. Eur J Business Social Sciences. 2: 69-81.

Relevant Topics

- Addiction

- Adolescence

- Children Care

- Communicable Diseases

- Community Occupational Medicine

- Disorders and Treatments

- Education

- Infections

- Mental Health Education

- Mortality Rate

- Nutrition Education

- Occupational Therapy Education

- Population Health

- Prevalence

- Sexual Violence

- Social & Preventive Medicine

- Women's Healthcare

Recommended Journals

Article Tools

Article Usage

- Total views: 11636

- [From(publication date):

October-2016 - Sep 03, 2025] - Breakdown by view type

- HTML page views : 10688

- PDF downloads : 948