Research Article Open Access

Analysis of Microfinance Banks Support to Agricultural Lending in Edo State, Nigeria

Omorogbe I1* and Aina SO21Department of Agricultural Economics, Ambrose Alli University Ekpoma, Edo state, Nigeria

2Department of Agricultural Extension and Management, Federal College of Horticulture, Dadin-kowa, PMB, Nigeria

- *Corresponding Author:

- Omorogbe I

Department of Agricultural Economics

Ambrose Alli University Ekpoma

Edo state, Nigeria

Tel: +2348035763491

E-mail: omoisaac2000@yahoo.co.uk

Received Date: November 20, 2016; Accepted Date: December 28, 2016; Published Date: January 12, 2017

Citation: Omorogbe I, Aina SO (2017) Analysis of Microfinance Banks Support to Agricultural Lending in Edo State, Nigeria. J Fisheries Livest Prod 5: 211 doi: 10.4172/2332-2608.1000211

Copyright: © 2017 Omorogbe I, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Visit for more related articles at Journal of Fisheries & Livestock Production

Abstract

The study assessed analysis of microfinance banks support to agricultural lending. Key objectives included examining the characteristics of MFBs in the State; identifying the agricultural loan products of the MFBs; determine the percentage of the MFBs’ annual loan portfolio allocated for agricultural lending; To achieve these objectives data were collected from the 18 MFBs in the state by means of questionnaire and interview schedule administered on key informant or company representative in each MFB. Analysis of data collected was done using descriptive statistics, hypotheses formulated were analysed using t-test. Major findings of the study revealed the average operational existence of the MFBs was 15 years while they have operated as licensed microfinance banks for an average of 12 years. The average branch network of the MFBs in the State was 4. Group lending method was the major (55.6%) lending practiced used by MFBs in the state while 44.6% used individual lending method. However, the preferred lending method was group method (100%), reasons being because of guaranteed repayment (83.3%), low default rate (66.7%) and influence of peer pressure in repayment collection (38.9%). Chi-square test suggests that there was no significant difference in the use of individual and group lending practices by MFBs in the state. However, t-test result (t=7.96; p<0.050) revealed that the amount of loan disbursed under the group lending method (N85,595,960) was significantly higher than that disbursed under the individual lending method (N32,127,040). Logit regression analysis showed that staff size (b=9.024) and branch network (b=62.74) were significant variables affecting MFBs probability of using the group lending method. Lack of collateral (mean=4.06), low educational status of farmers (mean=3.89), etc were major constraints affecting MFB lending to the agricultural sector. Instead of demanding for physical collateral before loan disbursement to farmers, MFBs can exploit social collateral.

Keywords

Support; Microfinance bank; Agricultural lending; Collateral

Introduction

Globally, 1.2 billion people are extremely poor (surviving on less than USD 1 a day), and three quarters live in rural areas. Poverty is predominantly a rural phenomenon. Extremely poor people spend more than half of their income to obtain (or produce) staple foods, which account for more than two thirds of their caloric intake. Most of these people suffer from nutritional deficiencies, and many go hungry at certain times of the year [1]. In recent years, development agencies and national governments have renewed their commitment to reducing poverty, hunger and other human deprivations, as evidenced by the Millennium Development Goals. Among other objectives, the goals aim to halve the proportion of people living on less than USD 1 a day by 2015 (from the starting level of 1990). That means cutting the share of extremely poor people in low- and middle-income countries from 28 to 14%.

The goals also call for halving the proportion of people suffering from hunger by 2015. Rural poverty and hunger fell sharply between 1975 and 1990, but the rate of poverty reduction has since slowed. Net aid (that is, official development assistance) to developing countries fell from 0.35% of the gross national income in the countries of the Organisation for Economic Co-operation and Development in 1982-83 to 0.24% in 2002-03. The real value of net aid disbursed to agriculture in the late 1990s was only 35% of the level in the late 1980s, according to IFAD. And, although the proportion of the economically active population engaged in agriculture has been falling in developing regions, it still exceeds 50% in Africa and Asia.

Agricultural finance has been one of the most prominent elements of the rural development strategies used by development agencies and national governments. Over the past 40 years, billions of dollars have been provided to support agricultural production and the Green Revolution. But this financing has long been characterized by poor loan repayment rates and unsustainable subsidies. Accordingly, agricultural credit from some donors and multilateral development banks has dropped dramatically in recent decades and is now often considered too risky. For example, agriculture accounted for 31% of World Bank lending in 1979-81, but by 2000-01 had fallen to less than 10% [2].

This drop was partly due to disappointment with large agricultural finance projects and partly to the fact that World Bank rural finance increasingly occurred in other areas: through microfinance projects or as part of community development, infrastructure, or rural development projects. Lending by other multilateral development banks and bilateral aid agencies has mirrored this trend. At the Inter- American Development Bank, total lending to agricultural credit projects under the category “global agricultural credit” fell from USD 1.6 billion between 1986 and 1990 to no lending at all in the period 1991-95.

Objectives of the Study

The main objective of the investigation is to assess the level of MFBs support to agriculture in Edo State. The specific objectives are to:

• Examine the characteristics of MFBs in the study area.

• Identify agricultural loan products of MFBs in the study area

• Examine the percentage of the MFBs’ annual loan portfolios allocated to agricultural lending.

• Identify constraints associated with agricultural lending by MFBs.

Hypotheses of the Study

The null hypotheses analyzed are stated below: MfB characteristics has no significant influence on the loan volume disbursed for agricultural lending.

Methodology

Area and scope of the study

The study was carried out in Edo State, Nigeria. The choice of study area was based on the presence of microfinance banks that are in operation in rural and urban setting. The State, which was created in 1991 out of the former Bendel State, has a land area of 19,794 square kilometres with an estimated population of 3,218,322 based on the 2006 national census estimate.

It has 18 local government areas distributed across three senatorial zones and is predominantly a rain forest region. The state is largely agrarian, producing crops such as cassava, groundnut, yam, cocoyam, rice, maize, plantain, rubber, cocoa, oil palm, pineapple, banana, orange and others. A large proportion of the population are engaged in farming, fishing, carving, and trading as well as the public civil service.

Sampling procedure and data collection

The target population for the study were microfinance institutions in the State. Given the small population of the CBN accredited MFBs in the state, which was 20 [3], all of them were selected for the study. Snow-ball sampling technique was used to identify and select 12 non- CBN accredited microfinance institutions. This brings the total sample to 32. However, only 30 responded positively to the researcher, while the remaining two refused to grant audience to the researcher.

Data collection method

Data for the study comprised of both secondary and primary data. Secondary data were collected on proportion of loan portfolio allocated to agriculture, while primary data were collected using interview schedule. The interview sessions were held with the MFB’s Managing Directors, Head of Operations, or their representatives.

Data collection instrument

The instrument for data collection was the questionnaire. This was structured in such a way as to obtain responses to answer the objectives formulated for the study.

Data analysis techniques

Data collected were analysed by the use of descriptive and inferential statistics. The descriptive statistics included frequency counts, percentages and mean scores. Inferential statistics used include chi-square, t-test and logit regression. Analysis of data was done using the Statistical Package for the Social Sciences (SPSS) version 20.

Results and Discussion

Characteristics of MFBs

The characteristics examined included MFBs year of establishment and accreditation by the Central Bank of Nigeria, sources of capital for disbursement, membership strength as well as income lines. Results of Table 1 revealed that 22.3% were established before 1990 while the highest proportion (27.9%) were established between 1995 and 1999. The average years of establishment were 15 years with a minimum and maximum range of 7 to 27 years respectively. The findings suggest that the MFBs have some good experience in microfinance operations.

| Frequency | Percent | Mean | SD | |

|---|---|---|---|---|

| 1990 and below | 4 | 22.3 | ||

| 1991 to 1994 | 3 | 16.7 | ||

| 1995-1999 | 5 | 27.9 | ||

| 2000-2004 | 3 | 16.7 | ||

| 2005-2009 | 3 | 16.7 | ||

| Total | 18 | 100 | 15 | 6.58 |

| Year of CBN Accreditation | ||||

| 1995-1999 | 6 | 33.6 | ||

| 2000-2004 | 4 | 22.3 | ||

| 2005-2009 | 7 | 39 | ||

| 2010-2013 | 1 | 5.6 | ||

| Total | 18 | 100 | 12 | 4.73 |

| Staff size of MFBs in the Study Area | ||||

| 100 and below | 3 | 16.7 | ||

| 101-200 | 8 | 44.8 | ||

| 301-400 | 4 | 22.3 | ||

| >400 | 3 | 16.8 | ||

| Total | 18 | 100 | 381 | 184.64 |

Table 1: Year of establishment, and CBN accreditation.

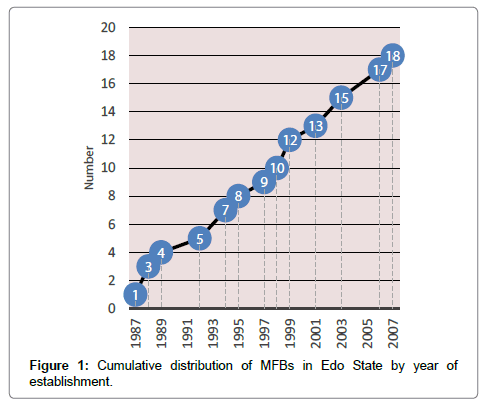

In Figure 1 shows the cumulative distribution of the MFBs based on years of establishment. The graph shows a steady increase in number of MFBs in the state from one in 1987 to 9 in 1997 and 18 by 2007.

Year of CBN accreditation

The results of Table 1 shows that more of the MFBs (39%) were accredited between 2005-2009, while 33.6% were accredited between 1995 and 1999. The MFBs had operated as licensed microfinance banks for an average of 12 years with range of 4 to 19 years minimum and maximum respectively. The results suggest that the MFBs have some experience in operating as microfinance banks. Although their years of operation as licenced financial institutions appears short when compared to commercial banks, Ovia [4] noted that this is because the Nigerian microfinance policy is relatively new having effectively kicked off since 1995.

Result of Table 2 reveals that the majority (44.8%) of the MFBs had a staff size of 101 to 200, 22.3% had 301-400, 16.7% had less than 100 while 16.8% had above 400. The average staff strength was 381. Usually the staff strength of the MFBs would deepen their rural outreach i.e. number of clients served [5].

| Frequency | Percent | Mean | SD | |

|---|---|---|---|---|

| 100 and below | 3 | 16.7 | ||

| 101-200 | 8 | 44.8 | ||

| 301-400 | 4 | 22.3 | ||

| >400 | 3 | 16.8 | ||

| Total | 18 | 100 | 381 | 184.64 |

Table 2: Staff Size of MFBs.

Branch network of MFBs in Edo State

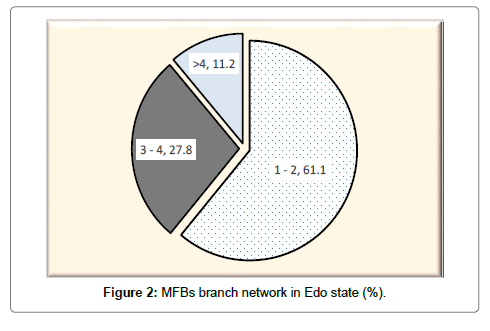

In Figure 2 revealed that 61.1% of the MFBs had over 4 branches in the State, 27.8% had 3-4 branches while 11.2% had 1-2. The average number of branches was 4. The more branch an MFB have the more clients they can reach out to.

Target Clients of MFBs

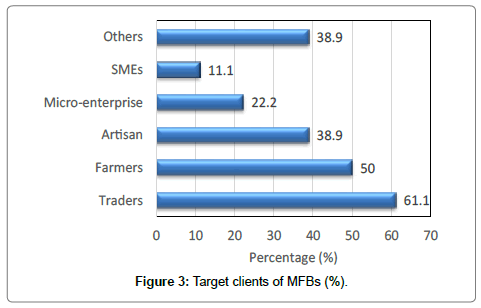

According to the results shown in Figure 3, the major clients of the MFBs were traders (61.1%), farmers (50%) and artisans (38.9%). Micro-entrepreneurs and small and medium scale enterprises were not major targets given their percentage of 22.2% and 11.1% respectively. The results are in line with the findings or assertions of Mwenda and Muuka [6] who noted that MFBs major clients are small business owners. Reason for MFBs’ preference for this set of clients is because they have daily income return and may be more capable of meeting up with their loan repayment unlike the authors. The results shown in Figure 3 equally showed that MFBs in the State are not contributing effectively to growth of SMEs given their low percentage. Similar observation has been made by Ovia [4] who noted that MFBs should be encouraged to target SMEs if that sector is to experience significant growth and expansion. However, Madugu and Bzugu [7] noted that an important constraint to MFBs intervention in the SME sector is because of the huge capital outlay required to undertake SME projects, which he noted that most MFBs are not financially capable of handling given their capital base.

MFBs' sources of funds

Results of Table 3 revealed that all the MFBs sourced capital from commercial banks (100%) and their clients (100%). The result agrees with the report of Microfinance Gateway [8] who noted that commercial banks and clients constitute major sources of funds to MFBs usually on-lending and savings respectively. About 27.8% of the MFBs equally received international funding. However, the proportion is small suggesting that the MFBs have controlling interest in their operations. It could also imply that the MFBs are yet to fully exploit international sources of funding for their operations. This equally agrees with observations of Microfinance Gateway [8] for microfinance institutions especially in developing countries. The major providers of microfinance capital, according to Anyanwu, include commercial banks and development finance institutions (DFI) such as the Nigerian Industrial Development Bank (NIDB).

| Sources | Freq | % |

|---|---|---|

| Commercial Banks | 18 | 100 |

| Foreign donors | 5 | 27.8 |

| Clients | 18 | 100 |

| Others (e.g. other MFB) | 2 | 11.1 |

Table 3: MFBs' sources of funds.

Agricultural loan product and volume

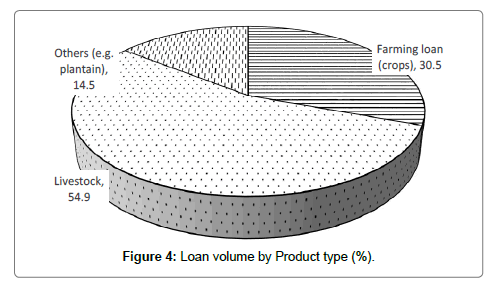

The identified agricultural loan product were loans to livestock and crop farming. In Table 4 shows all the MFBs were involved in disbursing loans to livestock farming, with a percentage of 54.9%, with the highest loan volume (about N64.6 million) followed by crop farming (about 35.9 million naira) with a percentage of 30.5%. Madugu and Bzugu [7] explains that the higher funding of livestock farming is because it enjoys a better risk assessment compared to crop farming which is more subject to the vagaries of weather. Furthermore, livestock production has better economic returns within a shorter time period.

| Loan volume (‘000 N) | ||

|---|---|---|

| Volume | % | |

| Farming loan (crops) | 35,961.67 | 30.5 |

| Livestock farming | 64,654.19 | 54.9 |

| Others (e.g. plantain) | 17,107.14 | 14.5 |

| Total | 1,17,723.00 | 100 |

Table 4: Agricultural loan product and volume.

Loan products and sectoral allocation by MFBs

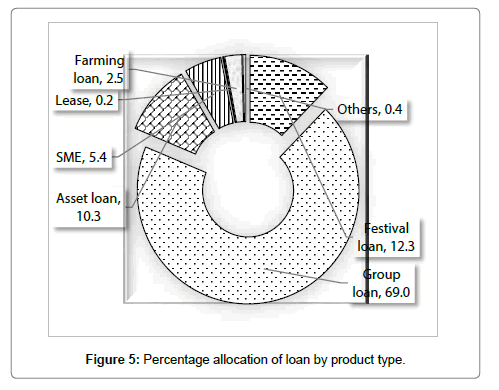

The results of Table 5 showed that most loan allocation was to group loan (about N3.3 billion) with a percentage of 69%. Festival (12.3%) and asset (10.3%) were with loan volumes of about N590 million and N493 million respectively. The results also showed that the percentage allocation by MFBs to the agricultural sector was about 2.5% (N117 million). The findings suggest that MFBs contribute little credit for agricultural development. Madugu and Bzugu [7] and FAO [9] had opined that the reluctance of financial institutions to support the agricultural sector with credit is traceable to the risk associated with the sector (Figure 4).

| Loan product/type | Freq | % | Loan volume (‘000N) | |

|---|---|---|---|---|

| Mean | % | |||

| Festival loan | 18 | 100 | 5,90,131.00 | 12.3 |

| Group loan | 18 | 100 | 33,10,610.00 | 69 |

| Asset loan | 18 | 100 | 4,93,405.00 | 10.3 |

| SME | 18 | 100 | 2,58,997.00 | 5.4 |

| Lease | 18 | 100 | 8,336.00 | 0.2 |

| Farming loan | 18 | 100 | 1,17,723.00 | 2.5 |

| Others | 18 | 100 | 20,828.00 | 0.4 |

| Total | 48,00,030.00 | 100 | ||

Table 5: Loan Products and Sectoral allocation by MFBs.

Constraints in lending to farmers

In Table 6 shows the constraints encountered by MFBs in lending to farmers in the study area. The findings of the table revealed that lack of collateral (mean=4.06), low educational status of farmers (mean=3.89) and uncertainty associated with the agricultural sector (3.00) were the major constraints since the mean scores were all higher than 3.00 (Figure 5).

| Total | ||

|---|---|---|

| Mean | SD | |

| Lack of Collateral | 4.06* | 1.06 |

| Illiteracy | 3.89* | 1.28 |

| Agricultural uncertainty | 3.00* | 1.5 |

| Poor record keeping | 2.78 | 1.48 |

| Seasonal nature of produce | 2.72 | 1.53 |

| Polygamy | 2.39 | 1.33 |

| Lack of steady income | 2.11 | 1.53 |

| Poor financial management skills | 1.61 | 1.04 |

*Serious (mean ≥ 3.00)

Table 6: Constraints in lending to farmers.

Assertions by Philip, Nkonya, et al. [10] confirmed that lack of collateral and uncertainty facing the agricultural sector were important constraints to commercial banks in disbursing loans for agricultural purposes. Agricultural practices is largely dependent on the weather conditions; unfortunately, it could be very difficult to predict weather conditions with 100% accuracy. Because of this risk associated with agricultural lending financial institutions usually require collateral before extending credit to the agricultural sector as well as other sectors. Unfortunately, farmers usually do not have sufficient collateral to benefit from institutional credit [1,3].

Other constraints such as poor record keeping by farmers (mean=2.78), seasonal nature of farm produce (2.72), polygamy (2.39), lack of steady income by farmers (2.11) and poor financial management skill of the farmers were not considered serious. However, about 11.1% of the respondents indicated that farmers’ lack of steady income was a very serious and serious limitation in their extending credit to farmers [11].

Conclusion

The study concludes that MFBs extend credit to the agricultural sector, but that the percentage allocation to the sector was too minimal. This suggests certain fears in dealing with the sector by MFBs in the state. The lending practices of the MFBs were both individual and group lending methods, but group method was highly preferred because of its better repayment and minimal loan default rate.

Recommendations

Based on the findings of the study the following recommendations are suggested:

• Instead of demanding for physical collateral before loan disbursement to farmers, MFBs can exploit social collateral usually associated with group loan lending practice. This entails the use of peer or group pressure to enhance repayment rate.

• To deal with the uncertainty characteristic of the agricultural sector, MFBs should link their farmer clients to insurance agencies whose premium rate should be easily affordable by the farmers.

• To make up for the farmers poor educational status, training programmes should be organized for them. Such training should focus on commercial systems of farming in order to encourage the farmers to improve their productivity and economic returns.

References

- Ehigiamusoe GE (2011) Financing Rural-Based Micro-Enterprises: Issues and Challenges. African Journal of Microfinance and Enterprise Development 1.

- Ehigiamusoe GE (2012) Issues in Microfinance Enhancing Financial Inclusion Mindex Publishing Company Limited, Lagos, Nigeria.

- CBN (2008) Statistical Bulletin, Golden Jubilee Edition.

- Ovia J (2007) Micro financing: Some cases, challenges and way forward. The Nigerian Microfinance Newsletter.

- Vega GC (2003) Deepening Rural Financial Markets: Macroeconomic Policy and Political Dimensions, Paving the Way Forward for Rural Finance. An International Conference on Best Practices. Washington.

- Mwenda KK, Muuka GN (2004) Towards best practices for micro finance institutional engagement in African rural areas. International Journal of Social Economics 31: 143-158.

- Madugu AJ, Bzugu PM (2012) The Role of Microfinance Banks in Financing Agriculture in Yola North Local Government Area, Adamawa State, Nigeria. Global Journal of Science Frontier Research Agriculture and Veterinary Sciences 12: 1-6.

- Microfinance Gateway (2010) Helping to Improve Donor Effectiveness in Microfinance.

- FAO (2004) Food and Agricultural Organization of the United Nations. Financing Agricultural Term Investment, Agricultural Finance.

- Philip D, Nkonya E, Pender J, Oni OA (2009) Constraints to Increasing Agricultural Productivity in Nigerian: a Review, Niger.

- Central Bank of Nigeria (2012) Revised Regulatory and Supervisory Guidelines for Microfinance Banks in Nigeria, Nigeria.

Relevant Topics

- Acoustic Survey

- Animal Husbandry

- Aquaculture Developement

- Bioacoustics

- Biological Diversity

- Dropline

- Fisheries

- Fisheries Management

- Fishing Vessel

- Gillnet

- Jigging

- Livestock Nutrition

- Livestock Production

- Marine

- Marine Fish

- Maritime Policy

- Pelagic Fish

- Poultry

- Sustainable fishery

- Sustainable Fishing

- Trawling

Recommended Journals

Article Tools

Article Usage

- Total views: 5954

- [From(publication date):

March-2017 - Aug 18, 2025] - Breakdown by view type

- HTML page views : 4833

- PDF downloads : 1121