Our Group organises 3000+ Global Conferenceseries Events every year across USA, Europe & Asia with support from 1000 more scientific Societies and Publishes 700+ Open Access Journals which contains over 50000 eminent personalities, reputed scientists as editorial board members.

Open Access Journals gaining more Readers and Citations

700 Journals and 15,000,000 Readers Each Journal is getting 25,000+ Readers

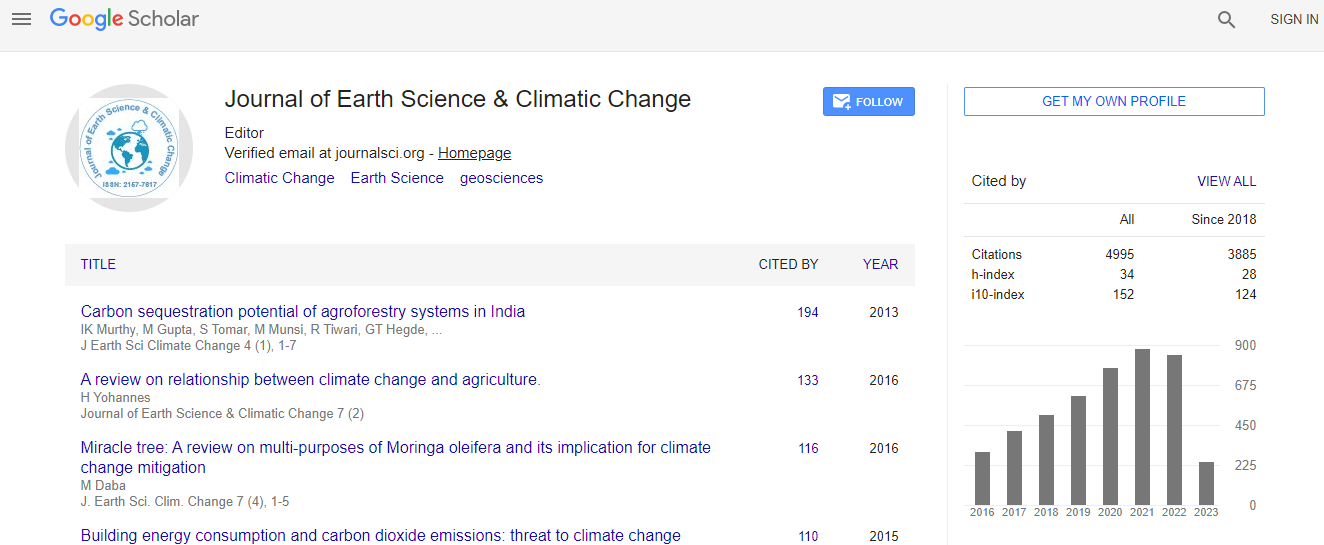

Google Scholar citation report

Citations : 5125

Journal of Earth Science & Climatic Change received 5125 citations as per Google Scholar report

Journal of Earth Science & Climatic Change peer review process verified at publons

Indexed In

- CAS Source Index (CASSI)

- Index Copernicus

- Google Scholar

- Sherpa Romeo

- Online Access to Research in the Environment (OARE)

- Open J Gate

- Genamics JournalSeek

- JournalTOCs

- Ulrich's Periodicals Directory

- Access to Global Online Research in Agriculture (AGORA)

- Centre for Agriculture and Biosciences International (CABI)

- RefSeek

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

- Proquest Summons

- SWB online catalog

- Publons

- Euro Pub

- ICMJE

Useful Links

Recommended Journals

Related Subjects

Share This Page

In Association with

Increasing losses caused by extreme weather events: What are the drivers and what is the role of climate change?

3rd World Congress on Climate Change and Global Warming

Peter Hoeppe

Munich Re, Germany

Keynote: J Earth Sci Clim Change

Abstract

Losses caused by natural disasters are a major factor influencing the balance sheet of insurers, especially reinsurers. Such events have a high potential of creating extreme accumulation losses. This is why the insurance industry has built up a lot of expertise in analyses and assess-ment of trends of losses caused by natural perils. Such losses have increased tremendously worldwide in the last decades. In order to detect the drivers of this trend the losses have to be adjusted for changes in exposed values. Munich Re just recently has developed a very sophisticated method for such a normalization of losses. After this normalization a still residual loss trend can be either driven by changes in the vulnerability of assets or on the hazard side. The results of such analyses with data of the Munich Re Nat Cat SERVICE database clearly show that in the last decades the main drivers of the loss trend have been changes in the exposure of values, i.e., growth of population and wealth in affected regions. Also a shift of population into more hazardous regions, especially to the coasts is increasing the losses. On the other side a clear signal of prevention measures, e.g., investment into flood protection, already can be detected in decreasing normalized losses caused by river floods, even though the number of intense precipitation events has increased. For thunderstorm related loss events the number of events as well as the normalized losses has increased significantly in North America and Europe. There is a suggestion that these increases are driven by an increase in the humidity of the lower atmosphere and thus, that this is a secondary effect of climate change. As global warming will continue in the coming decades, its contribution to increasing natural catastrophe losses will become more prominent, a projection also given by the 5th assessment report of the Intergovernmental Panel on Climate Change.Biography

Peter Hoeppe is the Chairman of the Munich Climate Insurance Initiative, which he founded in 2005 and had been appointed as Climate Change Advisor of the Bavarian State Government. He has completed his Masters and PhD in Meteorology and Human Biology.

Spanish

Spanish  Chinese

Chinese  Russian

Russian  German

German  French

French  Japanese

Japanese  Portuguese

Portuguese  Hindi

Hindi